Information Disclosure in Line with the Recommendations by the Task Force on Climate-related Financial Disclosures (TCFD)

Responding to climate change issues

Governance

Strategy Planning

Risk Management

Metrics and Targets

Responding to Challenges Related to Climate Change

In recent years, the impact of climate changes is progressively increasing, with frequent extreme weather events and natural disasters threatening the safety of people around the world. Reflecting this situation and since the adoption of the Paris Agreement at the Conference of the Parties (COP21) to the United Nations Framework Convention on Climate Change (UNFCCC) in 2015, the global momentum for climate change mitigation and adaptation is rising, pressuring businesses to proactively address climate changes through decarbonization and other initiatives.

The Yokohama Rubber group also considers that climate change mitigation and adaptation is as one of our most important management issues for contributing to a sustainable society and ensuring sustainable corporate growth. To make this position clear, we officially expressed our support for the TCFD recommendations, which encourages organizations toward broader disclosure of climate-related business and financial risks, in January 2022.

We will continue to actively disclose information on our efforts to address climate change in line with the TCFD recommendations.

The Yokohama Rubber group also considers that climate change mitigation and adaptation is as one of our most important management issues for contributing to a sustainable society and ensuring sustainable corporate growth. To make this position clear, we officially expressed our support for the TCFD recommendations, which encourages organizations toward broader disclosure of climate-related business and financial risks, in January 2022.

We will continue to actively disclose information on our efforts to address climate change in line with the TCFD recommendations.

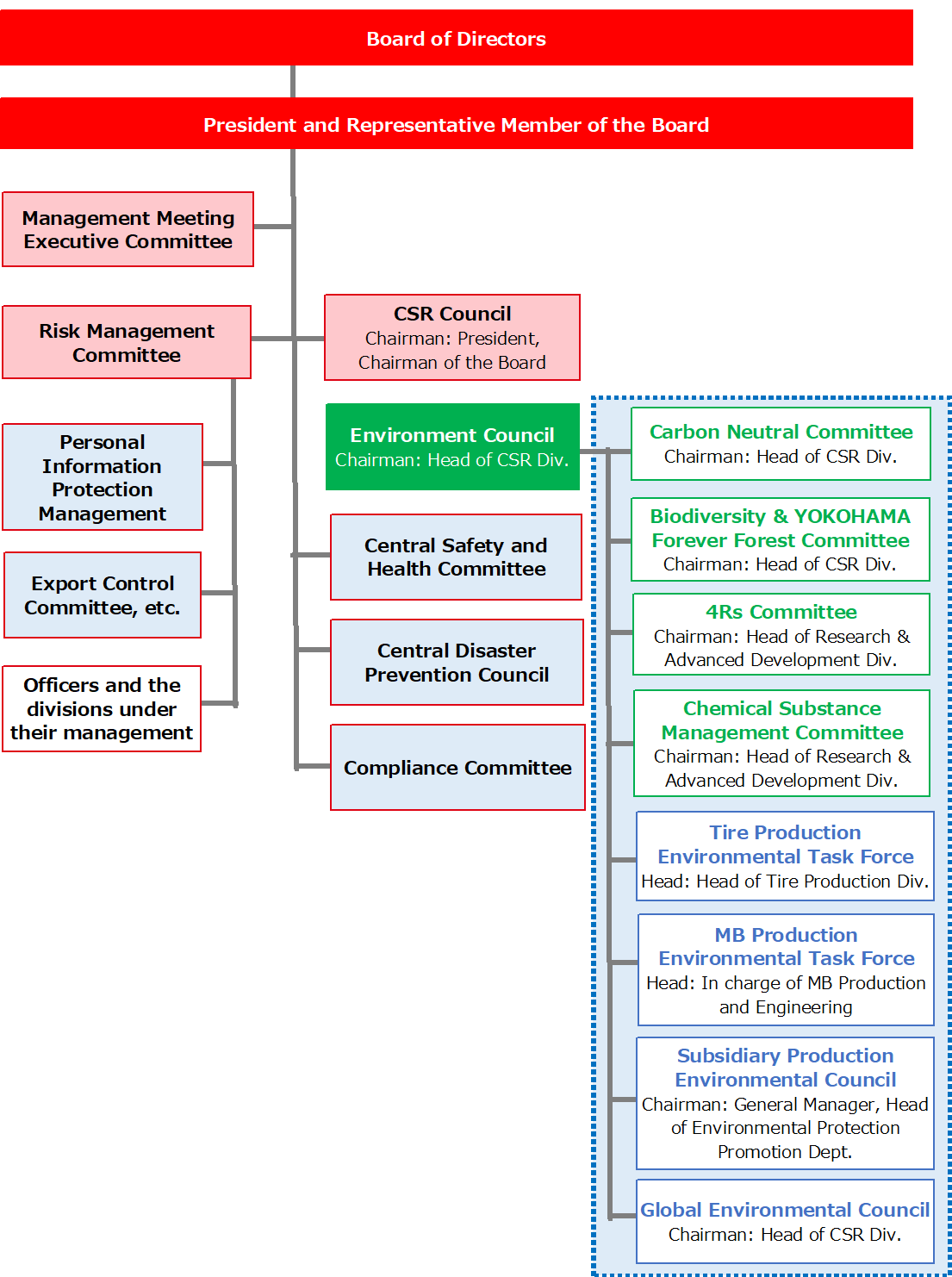

Governance

Our CSR Council, chaired by our president/CEO, meets twice a year (in May and November) to discuss issues related to climate change mitigation and adaptation as well as CSR issues and plan corporate actions to be taken by the Yokohama Rubber Group.

Specifically, in the area of climate change mitigation and adaptation, we have an Environment Council overseeing two task forces, two councils and four committees to promote our environmental efforts.

The Environment Council is chaired by the director who heads our CRS Division. The Council discusses and makes decisions regarding various issues such as carbon neutrality and oversees the environmental efforts by the entire Yokohama Group.

Specifically, in the area of climate change mitigation and adaptation, we have an Environment Council overseeing two task forces, two councils and four committees to promote our environmental efforts.

The Environment Council is chaired by the director who heads our CRS Division. The Council discusses and makes decisions regarding various issues such as carbon neutrality and oversees the environmental efforts by the entire Yokohama Group.

Climate Change-related Governance Structure

Strategy Planning

We classify climate-related risks into two categories, that are the risks associated with the transition to a low-carbon economy ("transition risks") and those associated with the physical impacts of climate changes ("physical risks"). We assess the magnitude of the financial impacts of these two risk groups and thereby more clearly define the risks and opportunities related to our business.

In addition, we conduct scenario analysis using the temperature rise scenarios presented by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC), and examined adaptation measures and financial impacts, etc. in the light of the risks and opportunities related with the 1.5°C-rise and 4°C -rise scenarios, respectively.

Going forward, we will continue to examine risks and opportunities and refine our scenario analysis.

In addition, we conduct scenario analysis using the temperature rise scenarios presented by the International Energy Agency (IEA) and the Intergovernmental Panel on Climate Change (IPCC), and examined adaptation measures and financial impacts, etc. in the light of the risks and opportunities related with the 1.5°C-rise and 4°C -rise scenarios, respectively.

Going forward, we will continue to examine risks and opportunities and refine our scenario analysis.

Major Risks and Opportunities Related to Climate Changes

| Material Factors | Category | Potential Financial Impact | Impact | ||

|---|---|---|---|---|---|

| Risks | transition risks | Transition to a decarbonized society | Policy and Regulations | Introduction and rise of carbon pricing | Large |

| Markets | Resource (raw material) price hikes and supply instability | Large | |||

| Increase in renewable energy and fuel prices (crude oil, natural gas) | Large | ||||

| Technology | Capital investment to improve manufacturing process efficiency | Medium | |||

| Reputation | Impact on customer evaluation of emission reduction efforts and stance, and on stock price | Small | |||

| Response to the global movement to promote the use of renewable energy (reputation among stakeholders) | Small | ||||

| Change in demand for products and services | Markets | Product selection based on evaluation of CO2 emissions during manufacturing (competition within the same product) | Large | ||

| Response to changes in the automotive industry | Markets | Decline in car sales due to MaaS | Large | ||

| physical risks | Intense weather disasters due to rising temperatures | Acute | Raw material procurement difficulties and higher procurement costs due to supply chain disruptions | Large | |

| Equipment damage or shutdown due to extreme weather | Large | ||||

| Intense climate change | Chronic | Depletion of natural rubber (natural resources) due to climate change, making procurement difficult | Large | ||

| Decline in demand for winter tires due to reduced snowfall, etc. | Large | ||||

| Increased R&D investment required to improve product performance | Medium | ||||

| opportunities | Transition to a decarbonized society | Energy Sources | Reduce energy costs by improving manufacturing process efficiency | Medium | |

| Products and Services | Increase market share by responding quickly to changes in demand (carbon neutral compliance and performance requirements for electric vehicle (EV) installation) and stricter regulations. | Large | |||

| Change in demand for products and services | Products and Services | Improve competitiveness and profitability by offering environmentally friendly products using renewable/recycled raw materials and fuel-efficient, low-carbon products | Large | ||

| Response to changes in the automotive industry | Products and Services | Increased demand for products and services that support next-generation mobility

(CASE and MaaS compliance, new business opportunities through hydrogen utilization) |

Large | ||

| Climate change | Products and Services | Increased demand for products and services that contribute to disaster prevention, recovery, temperature change, food, and nature

(e.g., tires, oil fenders, etc. that contribute to crop/forest growth) |

Large | ||

Summary of our scenario analysis

| Scenario Conditions | 1.5°C scenario | 4℃ scenario | |

|---|---|---|---|

| Scenario Overview | Limit the increase in the global average temperature to 1.5°C above pre-industrial levels by 2100 through stringent climate policies and technological innovation for sustainable development. | Failure of strict climate policies and technological innovation, and rapid intensification of the physical effects of climate change, resulting in a 4°C increase in average temperature by 2100 relative to pre-industrial levels. | |

| Reference Scenario | Transition risk | IEA

Net Zero Emissions by 2050 Scenario(NZE) |

IEA

World Energy Outlook 2021(WEO2021) |

| Physical Risk | IPCC 6th Report SSP1-1.9 | IPCC 6th Report SSP5-8.5 | |

| Analysis Results | Mainly transition risks/opportunities are manifested.

[Risks] Increased energy cost burden and capital investment to improve manufacturing process efficiency due to the need to comply with strict climate change regulations, procurement of renewable energy, and introduction of carbon pricing. Increased R&D and procurement cost burdens for renewable/recycled raw materials due to the increase in the number of products with reduced environmental impact. [Opportunities] Competitiveness and profitability will be enhanced through carbon neutral compliance, early response to EV-mounted performance requirements, and provision of environmentally friendly, fuel-efficient, and low-carbon products. |

Mainly physical risks/opportunities manifested.

[Risks] Increased occurrence of serious natural disasters at bases and in the supply chain. In addition, extreme weather conditions will deplete natural resources, making raw material supplies unstable. Product demand changes due to chronic climate change, such as lower demand for winter tires due to reduced snowfall, etc. [Opportunities] Increased demand for products and services for disaster prevention, recovery, and temperature fluctuations. |

|

Risk Management

Regarding risks related to climate change, the Carbon Neutral Promotion Committee and other task forces, councils, and committees operating under our Environment Council identify and assess the specific risks and lead the action to mitigate them. The more critical environmental risks identified by the individual task forces, councils or committees will be directly worked on by the Environment Council to decide corporate actions. For physical risks such as natural disasters, the Central Disaster Prevention Council promotes disaster control, and BCP and risk reduction efforts.

Of the above-mentioned types of risks, the most critical and urgent ones are discussed, evaluated and acted upon by the Risk Management Committee, chaired by the head of our Corporate Administration Division. The Risk Management Committee is a body provided for the purpose of strengthening our defense against various risks surrounding the Yokohama Rubber group.

The activities of the Risk Management Committee are regularly reported to the Board of Directors.

The activities of other committee bodies are reported to the Executive Committee as required, and may also be reported to the Board of Directors where appropriate.

Of the above-mentioned types of risks, the most critical and urgent ones are discussed, evaluated and acted upon by the Risk Management Committee, chaired by the head of our Corporate Administration Division. The Risk Management Committee is a body provided for the purpose of strengthening our defense against various risks surrounding the Yokohama Rubber group.

The activities of the Risk Management Committee are regularly reported to the Board of Directors.

The activities of other committee bodies are reported to the Executive Committee as required, and may also be reported to the Board of Directors where appropriate.

Metrics and Targets

In order to minimize risks related to climate changes, we have the following mid to long-term targets for our environmental activities.

| Item | Mid to Long-Term Targets |

|---|---|

| Carbon Neutral |

|

| Circular Economy |

|

| Coexistence with Nature |

|

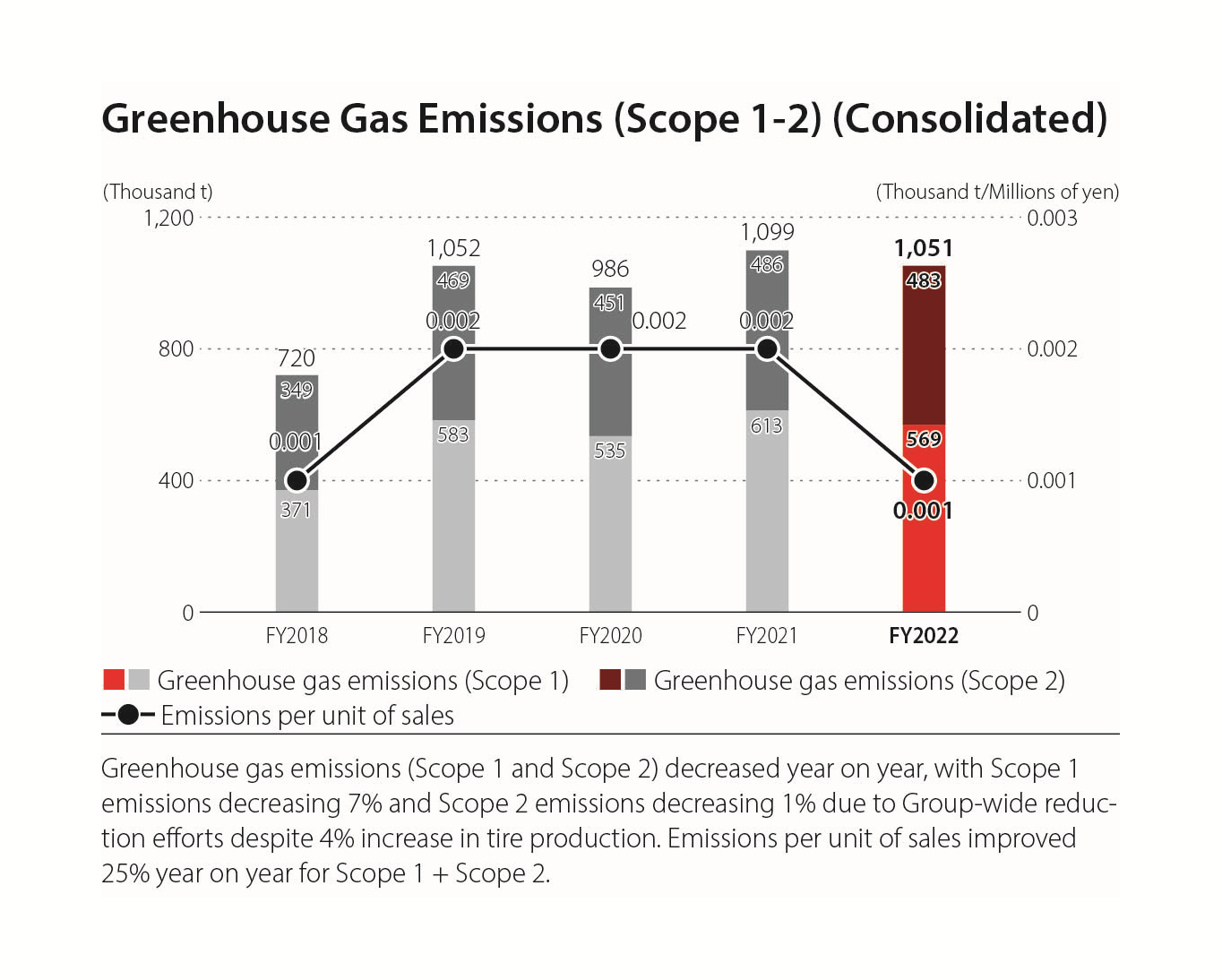

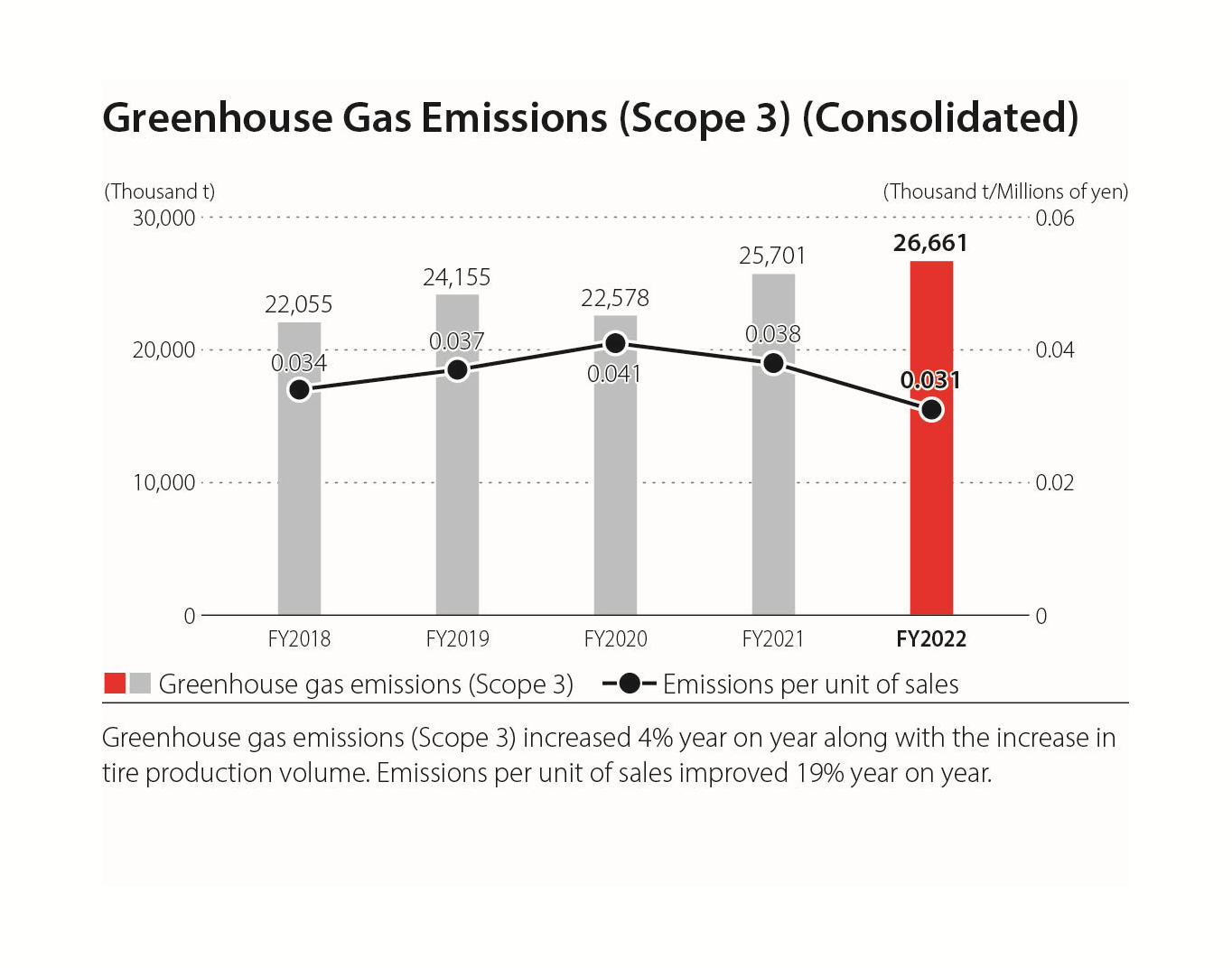

The records of our Scope 1 & 2 and Scope 3 greenhouse gas emissions are shown below.

Scope 3 calculation

The breakdown of Scope 3 is as follows.

Move the screen to the left or right to see the table information

(Emissions Unit: thousand t-CO2)

| Cat | Scope 3 category | FY2020 | FY2021 | FY2022 |

|---|---|---|---|---|

| 1 | Purchased products and services | 2,924 | 4,031 | 4,022 |

| 2 | Capital goods | 52 | 152 | 175 |

| 3 | Fuel and energy | 135 | 147 | 129 |

| 4 | Transportation and distribution (upstream) | 167 | 154 | 125 |

| 5 | Waste | 16 | 50 | 27 |

| 6 | Business travel | 3 | 5 | 5 |

| 7 | Commuting employees | 20 | 21 | 19 |

| 8 | Upstream lease assets | NA | NA | NA |

| 9 | Downstream transportation and distribution | 59 | 72 | 59 |

| 10 | Processing of sold products | 11 | 10 | 14 |

| 11 | Use of products | 18,259 | 19,940 | 21,087 |

| 12 | Disposal of products | 822 | 875 | 906 |

| 13 | Downstream lease assets | NA | NA | NA |

| 14 | Franchise | NA | NA | NA |

| 15 | Investment | 111 | 246 | 92 |

| SUM | 22,578 | 25,701 | 26,661 |

- 1 Scope 1: Direct emissions of greenhouse gases by the Company (examples: fossil fuel, natural gas, etc.)

- 2 Scope 2: Indirect emissions of greenhouse gases by the Company (electric power use, etc.)

- 3 Scope 3: Greenhouse gases emitted indirectly by the Company through its supply chain activities (manufacturing, transportation, business travel, commuting, etc.)

- 4 Calculation was conducted in accordance with the criteria of Scope 3 issued by the "GHG Protocol."

Verification of greenhouse gas (GHG) emissions

We had the calculation results verified by a third-party institution in order to ensure the accuracy and reliability of our GHG emission calculation.

- Third-party greenhouse gas verification report Emissions

On our Sustainability website, we disclose our environmental metrics such as water consumption, waste generation and also provides information about our biodiversity conservation actions through the Forever Forest Program.

For more statistical data, please use the following link:

Non-Financial Highlights

For more statistical data, please use the following link: