Governance

Governance System

Corporate Governance Support System

Corporate Governance Promotion Structure

Improvement of our Corporate Governance System

Remuneration for Corporate Officers and Directors

Corporate Governance Support System

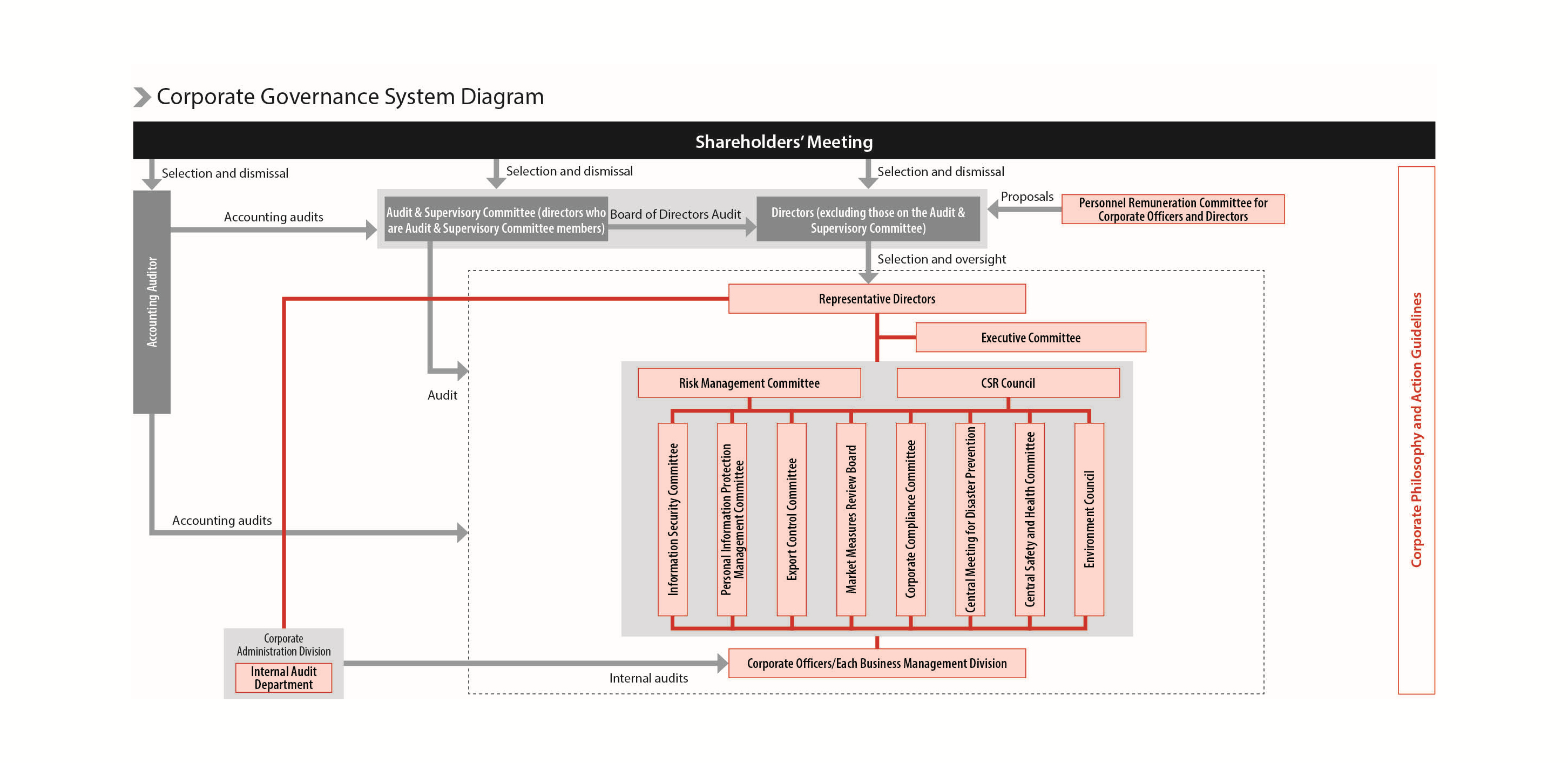

The institutional design under the Companies Act General Meeting of Shareholders, Representative Directors, Board of Directors, Audit & Supervisory Committee, and Accounting Auditor), the Company’s corporate governance system employs a corporate officer system to clarify management oversight and business execution while thoroughly speeding up management decision making and business execution.

In addition, to strengthen the strategic functioning of top management, we have established an Executive Committee on which directors serve as key members. The committee monitors the achievement status of business plans and deliberates matters concerning business strategy.

The Chair of the Board Meeting is our Chairman and President, who cannot serve as a Corporate Officer at the same time.

At the 147th Ordinary General Meeting of Shareholders held on March 30, 2023, a total of 16 directors (including 5 audit committee members) were elected: 8 internal directors and 8 external directors.

All of the appointed External Directors are Independent Directors.

The attendance rate of Internal Officers at meetings of the Board of Directors in 2022 was 100%, and the attendance rate of External Officers was as follows.

In addition, to strengthen the strategic functioning of top management, we have established an Executive Committee on which directors serve as key members. The committee monitors the achievement status of business plans and deliberates matters concerning business strategy.

The Chair of the Board Meeting is our Chairman and President, who cannot serve as a Corporate Officer at the same time.

At the 147th Ordinary General Meeting of Shareholders held on March 30, 2023, a total of 16 directors (including 5 audit committee members) were elected: 8 internal directors and 8 external directors.

All of the appointed External Directors are Independent Directors.

The attendance rate of Internal Officers at meetings of the Board of Directors in 2022 was 100%, and the attendance rate of External Officers was as follows.

FY2022 attendance status

| Board of Directors | ||

|---|---|---|

| Number of times attended | Attendance rate | |

| Director Hideichi Okada | 17/17 | 100% |

| Director Nobuo Takenaka | 15/17 | 88.2% |

| Director Hirokazu Kono | 17/17 | 100.0% |

| Director Yuko Kaneko | 11/13 | 84.6% |

| Director Masatoshi Hori | 17/17 | 100.0% |

| Audit & Supervisory Committee Member Jun Kamei | 16/17 | 94.1% |

| Audit & Supervisory Committee Member Megumi Shimizu | 17/17 | 100.0% |

| Audit & Supervisory Committee Member Hironori kimura | 15/17 | 88.2% |

- Positions as of the end of December 2022.

- Please refer to the section on officers in the annual report and Directors, Audit & Supervisory Board Members, and Corporate Officers (available only in Japanese) for the career history and scope of responsibilities of officers.

Reasons for the selection of Outside Directors and Outside Audit & Supervisory Board Members

- Hideichi Okada

Hideichi Okada will have served as an outside director of the Company for ten years at the conclusion of this General Meeting of Shareholders.

He has actively expressed his opinions and made proposals from an international perspective based on his deep insight into the economy, society, and other issues surrounding corporate management.

He continues to serve as an outside director of the Company in order to reflect his abundant experience at government ministries and agencies and his insight into corporate management in the field of oil exploration and production, etc. in the management of the Company.

He has maintained his independence, with no incidents that could have been deemed to be in conflict with the interests of ordinary shareholders, as defined by the Tokyo Stock Exchange. - Masatoshi Hori

Masatoshi Hori will have held the position of Outside Director of the Company for two years at the conclusion of this General Meeting of Shareholders.

In addition to his abundant experience and insight as a manager, he has actively expressed his opinions and made suggestions based on his practices and successful cases in M&A.

He continues to serve as an outside director so that his experience and insight can be reflected in the management of the Company.

He has maintained his independence, with no incidents that could have been deemed to be in conflict with the interests of ordinary shareholders, as defined by the Tokyo Stock Exchange. - Yuko Kaneko

Yuko Kaneko will have held the position of Outside Director of the Company for one year at the conclusion of this General Meeting of Shareholders. She has actively expressed her opinions and made proposals based on her experience and insight as a certified public accountant with extensive experience working at an auditing firm, as well as her experience as a university professor researching and teaching auditing theory and practice.

She has maintained her independence, with no incidents that could have been deemed to be in conflict with the interests of ordinary shareholders, as defined by the Tokyo Stock Exchange. - Junichi Furukawa

Junichi Furukawa is a corporate manager who possesses abundant experience and extensive knowledge of corporate management. The Company appointed him as an outside director in the belief that he will reflect his insights in finance and accounting and abundant knowledge with a sense of balance in the management of the Company.

He has maintained his independence, with no incidents that could have been deemed to be in conflict with the interests of ordinary shareholders, as defined by the Tokyo Stock Exchange. - Megumi Shimizu

Megumi Shimizu has long worked as an attorney and currently serves as a partner at a leading law office of Japan. The Company appointed her as an outside director in the belief that she will use her ample insight and knowledge as a law expert for the management of the Company.

She does not fall under the category of any matter that may cause a conflict of interest with general shareholders as defined by the Tokyo Stock Exchange, and is considered to be independent, but we have not filed a notification of her appointment as an independent director or auditor. - Hirokazu Kono

Hirokazu Kono has actively provided opinions and suggestions based on his deep insight accumulated through his long-year studies of management engineering and business administration at universities in Japan and the United States. He has been appointed as an outside director of the Company so that his extensive academic knowledge of management engineering and business administration, as well as his experience and insight as an outside director at Stanley Electric, can be reflected in the management of the Company.

He has maintained his independence, with no incidents that could have been deemed to be in conflict with the interests of ordinary shareholders, as defined by the Tokyo Stock Exchange. - Atsushi Kamei

Atsushi Kamei has actively provided frank opinions from the perspectives of his long years of experience and corporate management in leading retail business players. The Company appointed him as a director who is an Audit & Supervisory Committee member in the belief that he will continue to supervise the management of the Company from an external viewpoint.

He has maintained his independence, with no incidents that could have been deemed to be in conflict with the interests of ordinary shareholders, as defined by the Tokyo Stock Exchange. - Hiroki Kimura

Hiroki Kimura has provided useful suggestions and advice based on his business experience as a manager of a financial institution, his extensive experience as an outside director at other companies, and his professional insight in accounting, finance, and asset management to date.

The Company appointed him as a director who is an Audit & Supervisory Committee member in the belief that he will contribute to further reinforcing the auditing functions of the Company’s management with his professional knowledge accumulated in the fields of accounting, finance and asset management.

He has maintained her independence, with no incidents that could have been deemed to be in conflict with the interests of ordinary shareholders, as defined by the Tokyo Stock Exchange.

The Board of Directors’ Meeting was held 17 times in fiscal 2022, and 64 proposals were deliberated.

In addition, we seek and incorporate the opinions of institutional investors in matters including proposals at the General Shareholders’ Meeting for Outside Officers, proposals on dividends and the Corporate Governance Code, and proposals regarding the Stewardship Code response policy.

In addition, we seek and incorporate the opinions of institutional investors in matters including proposals at the General Shareholders’ Meeting for Outside Officers, proposals on dividends and the Corporate Governance Code, and proposals regarding the Stewardship Code response policy.

Under our systems, Audit & Supervisory Committee members can get know the status of our business operations by attending various important meetings or committees such as the Management Meeting, and the Internal Audit Office that serves as an independent organization conducts internal audits of each business to check that operations are being conducted properly.

We have three pillars in our auditing system: the audits done by our Audit & Supervisory Committee members who supervise work execution by our Directors, accounting audits done by our independent accounting auditors as external audits, and finally, the audits done by our Internal Audit Department for work operation by our each corporate division and group companies, plus accounting audits. They function by maintaining each other’s independency; by establishing the three pillars of the audit system, our Audit & Supervisory Committee members can fortify the function of Audit & Supervisory Committee members by obtaining information from our Accounting Auditors and Internal Audit Department in a timely manner.

Also, in order to secure transparency and fairness in relation to the appointment and various benefits of our Directors, we determine them at the Board of Directors’ Meeting by establishing a voluntary Personnel/Remuneration Committee for Corporate Officers and Directors followed by our review.

The Personnel/Remuneration Committee for Corporate Officers had three Members (of which two were Outside Members) during the fiscal year from April 2020 to March 2021. As required by law, all transactions by directors that could be deemed to have conflict of interest implications and all transactions involving competitor firms were subject to approval by the Board of Directors, with the results being reported at Board Meetings.

The Personnel/Remuneration Committee for Corporate Officers had three Members (of which two were Outside Members) during the fiscal year from April 2020 to March 2021. As required by law, all transactions by directors that could be deemed to have conflict of interest implications and all transactions involving competitor firms were subject to approval by the Board of Directors, with the results being reported at Board Meetings.

Corporate Governance Promotion Structure

Improvement of our

Corporate Governance System

We have made resolutions under the “Basic Guidelines for Corporate Governance in Accordance with the Companies Act” during our Board of Directors’ Meeting in May 2006. Not only do we follow up with their activity status every year, we also keep making further enhancements such as our review by aiming for clearer description of the “Guidelines of the Elimination of Anti-Social Behavior” in April 2009 and re-establishment of the Basic Guidelines following the revision of the Companies Act in June 2015. Also, to comply with the J-SOX Law effective from the fiscal year of 2008 (evaluation of support system for financial account in accordance with Financial Instruments and Exchange Act), it has been confirmed that our corporate governance system is effective both in internal and external evaluation in the fiscal year of 2022. We will continue to make improvements on this aspect as well in order to maintain sustainable and effective functionality.

In addition, the Audit Department conducts annual operational audits.

Based on the Audit Procedures, audits are conducted on 11 items ranging from accounting operations to safety, environment, and industrial waste management to ensure that operations are carried out in accordance with rules and procedures, and recommendations for improvement are made to prevent fraud and errors.

We then make recommendations and suggestions for improvement and strive to prevent fraud and errors.

In FY 2022, 16 business sites were audited and 474 recommendations and suggestions were made.

In addition, the Audit Department conducts annual operational audits.

Based on the Audit Procedures, audits are conducted on 11 items ranging from accounting operations to safety, environment, and industrial waste management to ensure that operations are carried out in accordance with rules and procedures, and recommendations for improvement are made to prevent fraud and errors.

We then make recommendations and suggestions for improvement and strive to prevent fraud and errors.

In FY 2022, 16 business sites were audited and 474 recommendations and suggestions were made.

Remuneration for

Corporate Officers and Directors

Candidates for Directors and Audit & Supervisory Board Members are selected by the Personnel/Remuneration Committee for Directors and Audit & Supervisory Board Members, which consists of one internal officer and two external officers, and after a resolution by the Board of Directors, the appointment is submitted to the General Meeting of Shareholders for approval. With regard to remuneration, transparency and fairness are secured by the Personnel/Remuneration Committee for Corporate Officers and Directors, and remuneration is decided on by the Board of Directors. Regarding the remuneration of Audit & Supervisory Board Members, the Board of Directors has established a policy of “determining remuneration by Audit & Supervisory Board Members after deliberation by the Board of Directors in order to ensure the transparency, fairness, and independence of audits.” It was 479 million yen for directors and 91 million yen for auditors in fiscal 2022. We seek the opinions of stakeholders through means such as a shareholder questionnaire and the “Contact Us” page of our official website.

Details of executive remuneration

| Executive category | Total remuneration (Million yen) |

Total by type of remuneration (Million yen) |

Number of applicable executives (persons) |

|||

|---|---|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration | |||||

| Bonus | Restricted stock compensation | Medium-term performance-linked remuneration | ||||

| Directors (excluding Outside Directors) |

424 | 184 | 73 | 110 | 57 | 7 |

| Audit & Supervisory Board Members (excluding Outside Audit & Supervisory Board Members) |

66 | 45 | 20 | - | - | 2 |

| Outside Officers | 80 | 80 | - | - | - | 9 |