News Release

Yokohama Rubber Posts Record First-Quarter Sales

2023.May.12

- Management relation

Hiratsuka, Japan—The Yokohama Rubber Co., Ltd., announced today its business and financial results for the first quarter (January to March) of fiscal 2023. Profit attributable to owners of parent declined 4.4% from the same period of the previous year, to \9.7 billion; on a 2.4% decline in operating profit, to \13.2 billion; a 4.8% decline in business profit*, to \13.0 billion; and a 10.1% increase in sales revenue, to \204.3 billion.

* Basically equivalent to operating income under accounting principles generally accepted in Japan and calculated as sales revenue less the sum of cost of sales and selling, general and administrative expenses.

The figure for sales revenue was the highest ever at Yokohama Rubber in the January-to-March quarter. It reflected successful marketing of high-value-added tire products, such as ADVAN-brand high-performance tires and GEOLANDAR tires for SUVs and pickup trucks, and improvements in product mix. It also reflected progress in implementing price increases and the weakening of the yen against other principal currencies during the quarter. Earnings in Yokohama Rubber’s tire business reflected increases in raw material prices, logistics cost, and energy costs and reduced unit production at automakers on account of shortages of semiconductor devices.

First-quarter sales revenue in Yokohama Rubber’s Tires segment increased over the same period of the previous year, but business profit declined. Sales revenue in original equipment tires increased as Yokohama Rubber won new fitments on vehicles in Japan and in North America and as sales benefited from the weakening of the yen against other principal currencies. Those positive factors more than offset weakness in shipments to automakers in China.

Sales revenue also increased in replacement tires. In Japan, sales revenue benefited from heavy snowfalls, which stimulated demand for studless winter tires. Yokohama Rubber achieved sales growth in China and in other Asian markets outside Japan by promoting high-value-added products in the ADVAN series and under other brands. Sales revenue declined in the Yokohama Off-Highway Tires unit (formerly the ATG [Alliance Tire Group] segment), which produces and markets off-highway tires (hereinafter, OHT) for agricultural and construction machinery and other application.

* Yokohama Rubber has absorbed the ATG segment into its Tires segment as of fiscal 2022. That is on account of similarities between the two segments in regard to customers and product characteristics.

In Yokohama Rubber’s MB (Multiple Business) segment, sales revenue and business profit increased over the same period of the previous year. Sales revenue in hose & couplings increased, benefiting from a recovery in vehicle production in North America. Yokohama Rubber also posted growth in sales revenue in industrial materials as Japanese business in conveyor belts expanded and as demand for replacement fixtures and components recovered in the commercial aircraft sector.

* Yokohama Rubber absorbed its business in aerospace products into the industrial products division on March 30, 2022.

Management at Yokohama Rubber has revised upward the full-year fiscal projections for 2023 that it announced in February 2023. That revision is on account of the acquisition of Trelleborg Wheel Systems Holding AB (hereinafter, TWS) on May 2, 2023. The revised projections call for profit attributable to owners of parent to total \57.0 billion, 23.9% higher than the earlier projection; on operating profit of \87.0 billion, 19.2% higher than the earlier projection; business profit of \84.5 billion, 15.8% higher than the earlier projection; and sales revenue of \1.0 trillion, 11.1% higher than the earlier projection.

The TWS acquisition is part of Yokohama Rubber’s strategic initiatives to expand its OHT business. Yokohama Rubber believes that, among commercial tires, OHT business is capable of securing stably high earnings. The acquisition will bring consumer tire to commercial tire sales composition of Yokohama Rubber’s tire business in line with the global tire market ratio of 1:1, from the current 2:1 ratio weighted toward consumer tires. In addition, this acquisition will lead to further growth of Yokohama Rubber’s OHT business through synergies generated by the combined strengths of both companies in all areas, from the development of new products and services to manufacturing, sales, quality control, and sustainability.

Progress of YX2023 medium-term management plan

Under Yokohama Transformation 2023 (YX2023), the company’s medium-term management plan for fiscal years 2021–2023, Yokohama Rubber is simultaneously promoting the “exploitation” of the strengths of its existing businesses and the “exploration” of new value that will meet the needs of customers and society in an era of great change, as the company strives for "transformation" that will drive growth over the next generation.

Consumer tires

The consumer tire business is aiming to expand the sales ratio of high value-added tires from 40% in 2019 to more than 50% by increasing sales of its ADVAN, GEOLANDAR, and WINTER tires. Toward that end, the business has been making efforts to expand use of ADVAN and GEOLANDAR brand tires as original equipment (OE), strengthen sales in the replacement market, expand size lineups, including for WINTER tires, and strengthen sales of tires suited to local market needs.

Success in the OE market thus far in 2023 include Toyota Motor Corporation’s adoption of ADVAN tires as OE on its GR Corolla and GRMN Yaris models and BluEarth tires as OE on its environment-friendly Prius and Prius PHEV. The consumer tire business also continues to strengthen its product lineup, launching sales in North America and Australia of the GEOLANDAR A/T XD, a new all-terrain tire designed for use especially on large commercial vehicles, including full-size pickup trucks. Motorsports activities thus far in 2023 included first-place finishes by cars running on ADVAN tires in the second round of the Nürburgring Endurance Series and in the GT300 class at the first two rounds of this year’s SUPER GT Series, Japan’s ultimate touring car racing series. In addition, a vehicle running on GEOLANDAR tires won the King of the Hammers’ 4900 Can-Am UTV race, an off-road race in the United States. Aiming to strengthen development of winter tires, the company opened Japan’s largest indoor ice circle test facility at its Tire Test Center of Hokkaido. In addition, as part of the segment’s structural reforms, the company sold its entire holdings in Friend Tire Company, a previously wholly owned tire wholesaler in the United States.

Commercial tires

The commercial tire business continues to explore opportunities created by market changes, with a focus on four themes—cost, service, digital transformation (DX), and strengthening its product lineup. In addition to the recent acquisition of TWS, Yokohama Rubber’s efforts to strengthen its commercial tire business include establishing new tire solution services. Toward that end, the company recently began practical testing of its air-pressure sensors attached to the inner surface of tires and its Tire air Pressure Remote access System (TPRS) on an EV bus.

MB businesses

In the MB segment, Yokohama Rubber is continuing to concentrate its resources in the segment’s two strongest businesses—hose & couplings and industrial products—as it seeks to transform the segment into a generator of stable earnings. The industrial products business continued its efforts to maximize its share in the conveyor belt market, launching two new products—Hamaheat #2110, a flame-retardant medium-heat resistant conveyor belt, and Hamaheat Super 80, a high-temperature heat-resistant conveyor belt.

ESG activities

Yokohama Rubber regards ESG activities as an important strategy that will contribute to the strengthening of its business and lead to sustainable increases in its corporate value. Environment-related initiatives in 2023 have included joining to forums dedicated to achieving nature positivity—Japan’s 30by30 Alliance for Biodiversity and Taskforce on Nature-related Financial Disclosures’ TNFD Forum. Social-related initiatives include continuing support for the activities of organizations that contribute to society and support for disaster-stricken areas and local communities provided by the employee-backed YOKOHAMA Magokoro Fund. Corporate governance–related initiatives included the transition to a company with an Audit & Supervisory Committee in March, a move intended to strengthen the supervisory function of the Board of Directors and speed up management decision-making. In addition, the company continued to unwind cross-shareholdings, as part of its continuing effort to improve capital efficiency and achieve sustainable increases in corporate value.

In April 2023, Yokohama Rubber entered into an affiliation agreement with Japanese swimmer Rikako Ikee. Just days after entering into the new relationship with Yokohama Rubber, Ms. Ikee won four titles at the Japan Swim 2023, qualifying to compete in the butterfly and freestyle competitions at the World Aquatics Championships—Fukuoka 2023 to be held from July 14. Yokohama Rubber looks forward to supporting Ms. Ikee as she seeks to realize her dreams as a swimmer on the global stage and becomes more active in a wider social stage, including through her participation in many Yokohama Rubber activities.

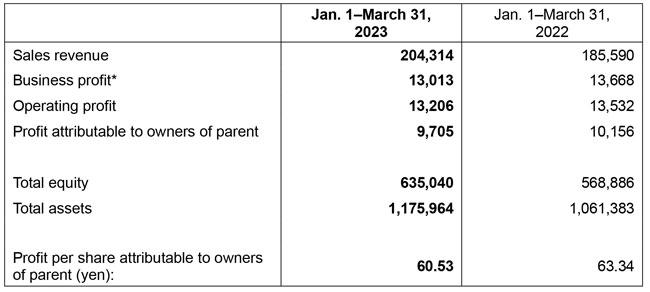

Financial Highlights (Millions of yen)

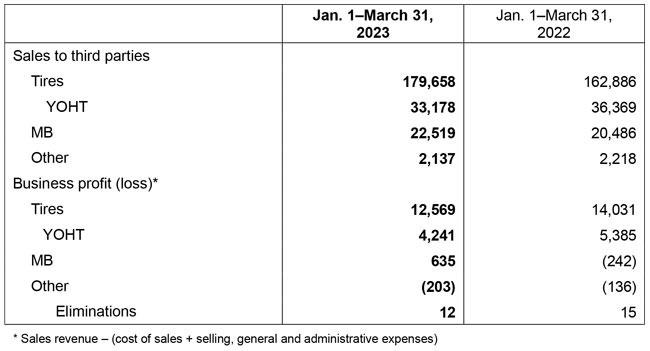

Results by Business Segment (Millions of yen)