News Release

Yokohama Rubber Announces Fiscal Results for 2016

2017.February.20

- Management relation

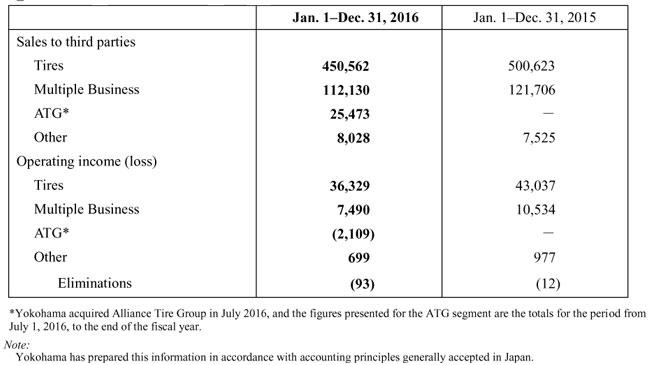

Tokyo - The Yokohama Rubber Co., Ltd., announced today that its profit attributable to owners of parent declined 48.3% in fiscal 2016 (January to December 2016), to 18.8 billion yen, on declines of 22.4% in operating income, to 42.3 billion yen, and 5.3% in net sales, to 596.2 billion yen. Yokohama’s operating income exceeded the projection announced by the company in August 2016, though the figures for profit attributable to owners of parent and net sales were below the August projections. The downturns in sales and earnings reflected adverse conditions in overseas tire markets, including the appreciation of the yen and declining prices. Yokohama achieved an increase in earnings in its tire business in Japan.

In July 2016, Yokohama acquired Alliance Tire Group B.V., which manufactures and markets tires for agricultural, industrial, construction, and forestry machinery. Yokohama has included the operations of Alliance Tire Group in its consolidated results as the ATG segment as of July 1, 2016, and ATG sales were consistent with management’s expectations in volume and value. Sales and earnings declined in Yokohama’s Multiple Business segment on account of weak demand. Yokohama paid an interim dividend of 26 yen per share, and management proposes to pay a year-end dividend of 26 yen per share. The annual dividend would thus total 52 yen per share.

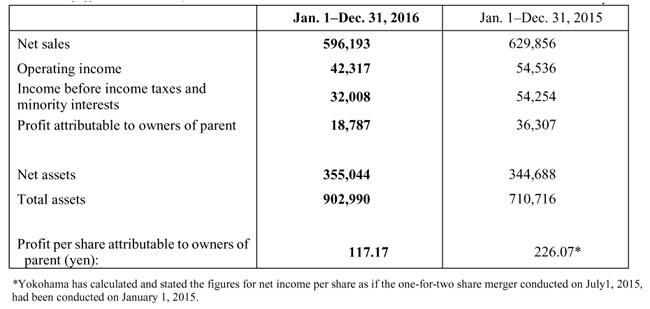

Sales in Yokohama’s Tires segment declined 10.0%, to 450.6 billion yen, and operating income declined 15.6%, to 36.3 billion yen. The company’s business in Japan’s original equipment market declined in sales value on account of a decline in unit vehicle production and slumping prices. Operating income in Yokohama’s Japanese original equipment business rose, however, on account of declining prices for raw materials. Yokohama’s tire business in the Japanese replacement market declined in unit volume, but successful promotion of high-value-added products improved the composition of the company’s sales portfolio and produced an increase in operating income. The company’s tire business outside Japan declined in sales and operating income on account of the appreciation of the yen and escalating price competition, though unit volume increased. Unit volume was flat in North America but increased in Europe, partly as the result of Yokohama’s progress in cultivating new sales channels, and also increased in the Chinese original equipment market.

In Yokohama’s Multiple Business segment, sales declined 7.9%, to 112.1 billion yen, and operating income declined 28.9%, to 7.5 billion yen. That segment consists primarily of business in high-pressure hoses; Hamatite sealants and adhesives and electronic equipment coatings; conveyor belts; antiseismic products; marine hoses and pneumatic marine fenders; and aircraft fixtures and components. Sales in high-pressure hoses declined, reflecting a decline in Japanese production of construction equipment. Sales also declined in industrial materials amid a downturn in Japanese steel production and slumping prices for natural resources. Operating income increased in Hamatite sealants and adhesives and electronic equipment coatings, driven by North American sales gains in automotive sealants, but sales declined overall on account of slumping Japanese demand. Sales declined in aircraft fixtures and components as weakness in the commercial sector more than offset sales gains in the government sector.

Sales in the ATG segment totaled 25.5 billion yen. Business in that segment was consistent with management’s projections, as noted, in regard to unit volume and sales value. It reflected vigorous measures for promoting sales amid slumping demand and escalating price competition associated with a decline in grain prices. Yokohama has recorded an operating loss of 2.1 billion yen for the ATG segment in fiscal 2016. That reflects the inclusion of acquisition-related expenses under selling, general and administrative expenses and the amortization of goodwill.

Yokohama’s fiscal projections for 2017 call for profit attributable to owners of parent to increase 59.7%, to 30.0 billion yen, on a 12.2% increase in operating income, to 47.5 billion yen, and a 10.7% increase in net sales, to 660.0 billion yen. The company will adopt the International Financial Reporting Standards in fiscal 2017. Recalculating the fiscal 2017 projections under those standards results in projections of 51.0 billion yen for operating income, and 635.0 billion yen for net sales.

Financial Highlights (Millions of yen)

Results by Business Segment (Millions of yen)