News Release

Yokohama Rubber's Operating Profitability Exceeds Expectations for First Six Months of Fiscal Period

2011.November.10

- Management relation

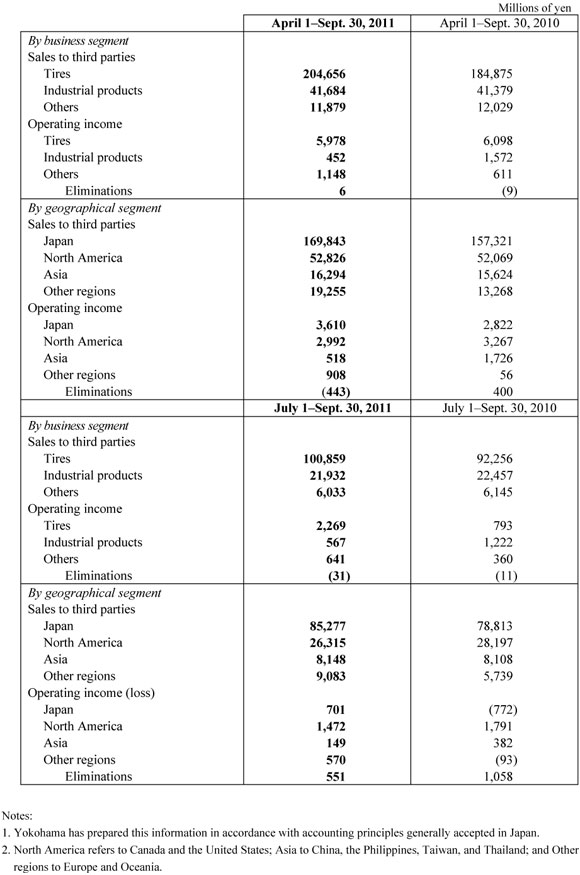

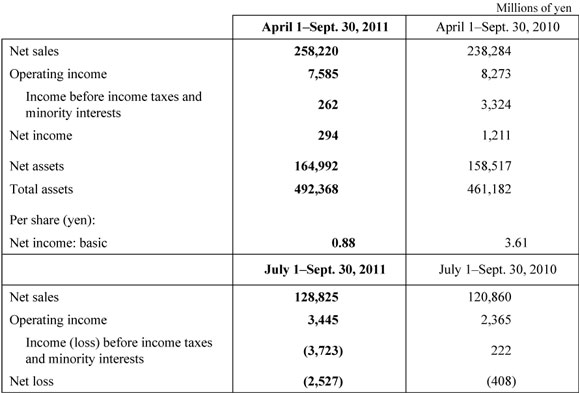

Tokyo-The Yokohama Rubber Co., Ltd., announced today that its net sales from April to September 2011, the first six months of the present fiscal term, increased 8.4%, 19.9 billion, over the same period of the previous fiscal year, to 258.2 billion yen. That growth resulted primarily from a surge in tire business, led by strong sales in Japan's replacement market.

Operating income declined 8.3% from the same period of the previous year, to 7.6 billion yen, on account of rising raw material costs, the appreciation of the yen, and an increase in selling, general and administrative expenses. The figure for operating income was 26.7% higher, however, than Yokohama's earlier projection of 6.0 billion yen. Yokohama's higher-than-projected operating profitability reflected increases in selling prices for products and progress in trimming costs. Net income declined 75.7%, to 294 million yen, as the appreciation of the yen occasioned losses on currency translation adjustments and as Yokohama recorded a nonrecurring loss in connection with severance payments at a subsidiary.

As noted, Yokohama posted a 10.7% sales increase in tires, to 204.7 billion yen. Operating income in the company's tire operations declined 2.0%, to 6.0 billion yen, on account of rising raw material costs and the appreciation of the yen. Yokohama's strong sales gains in replacement tires in Japan reflected growth in the used-vehicle market. Those gains more than offset a sales decline in original equipment tires, which reflected the aftereffects of the Great East Japan Earthquake. Yokohama also posted sales gains in tires overseas, led by growth in Asia and in Europe.

Yokohama posted sales growth of 0.7%, to 41.7 billion yen, in industrial products, which consist mainly of high-pressure hoses, sealants and adhesives, conveyor belts, anti-seismic products, marine hoses, and marine fenders. Operating income in industrial products declined 71.2%, to 452 million yen, on account of rising raw material costs and the appreciation of the yen. Sales of high-pressure hoses increased as gains in hoses for construction equipment offset declines in automotive hoses, which reflected the aftereffects of the Great East Japan Earthquake. The aftereffects of the earthquake also accounted for a sales decline in sealants and adhesives. Other positive sales factors in industrial products included an increase in overseas orders for marine hoses and a recovery in demand for conveyor belts.

Sales in other products, which consist mainly of aircraft fixtures and components and golf equipment, declined 1.2%, to 11.9 billion yen. That decline occurred as weakness in golf equipment more than offset a sales increase in replacement lavatory modules for commercial airliners. Cost savings and productivity gains supported an 87.8% increase in operating income in other products, to 1.1 billion yen.

Yokohama is switching its fiscal accounting in 2011 to a calendar-year basis, from an April-March accounting period. The change will bring the accounting periods at the parent company and Japanese subsidiaries into conformance with the calendar-year accounting employed at Yokohama's overseas subsidiaries. It will result in an irregular, nine-month fiscal period of April to December 2011 and will therefore preclude meaningful year-on-year comparisons of business results.

The company has revised its business and financial projections for the nine-month fiscal period in accordance with the growing fiscal and financial uncertainty worldwide, the continuing strength of the yen, and the rising cost of raw materials. Yokohama's latest projections call for net sales of 460.0 billion yen, operating income of 21.0 billion yen, and net income of 8.5 billion yen in the nine-month fiscal period to December 31, 2011. Yokohama has announced that the annual dividend will total 7 yen per share: an interim dividend of 3 yen and a period-end dividend of 4 yen.

Financial Highlights

Results by Business Segment and by Region