Tire Business

The Yokohama Rubber Group has launched its new medium-term management plan, Yokohama Transformation 2023 (YX2023), which will guide the group during the three years from fiscal 2021 through fiscal 2023.

Impact of CASE/MaaS on Tire Business

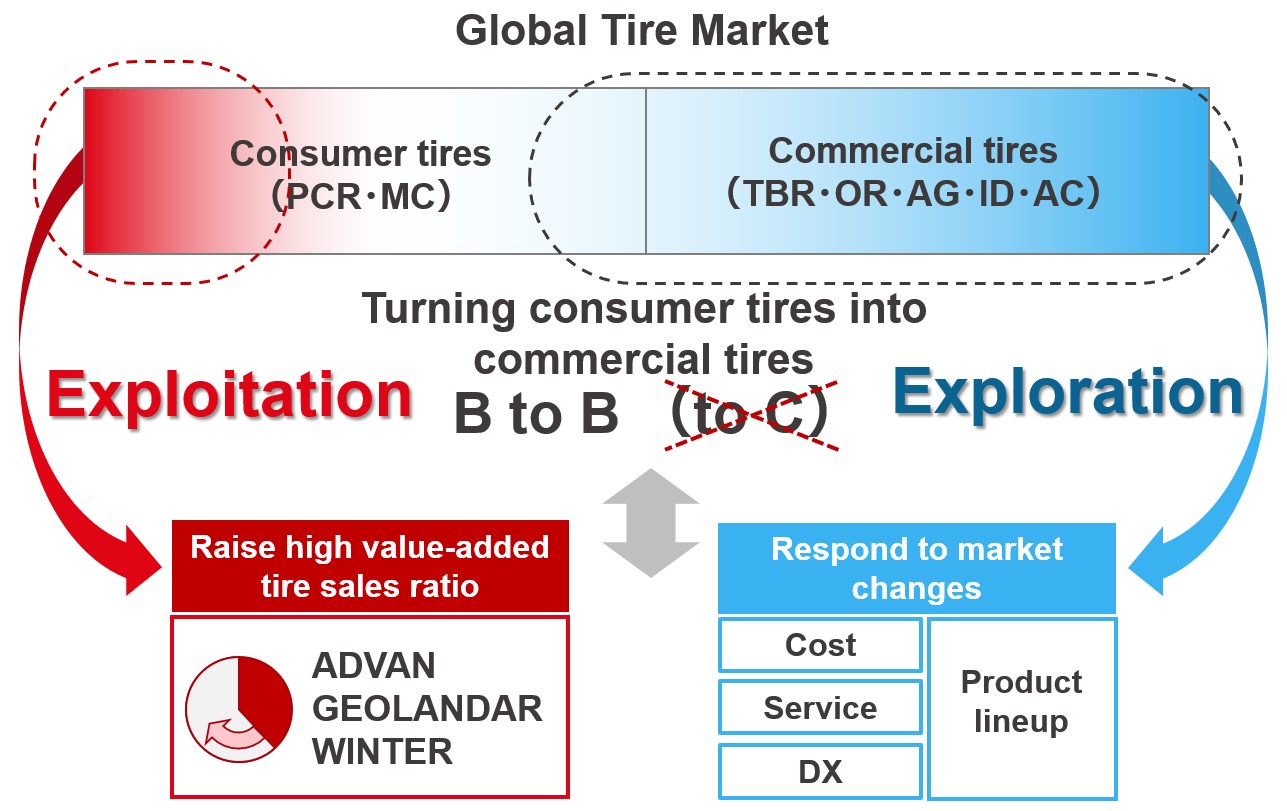

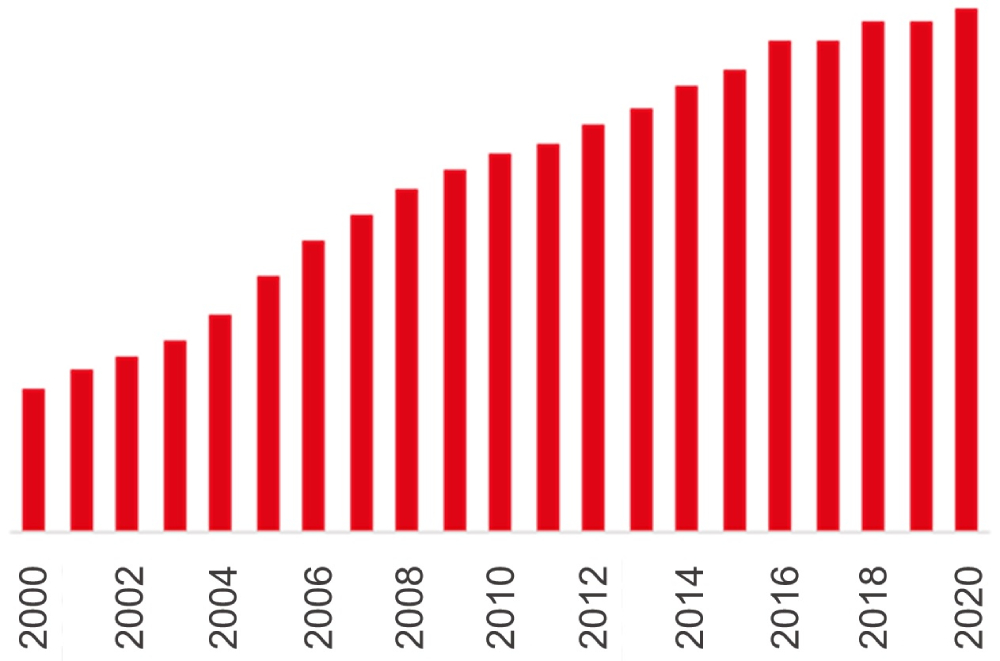

The tire market actually is composed of two distinct markets — the consumer tire market centering on passenger car tires and the commercial tire market, which includes tires for trucks, buses, agricultural machinery and other commercial-use vehicles. At present, these two markets are about equal in scale. However, as the CASE, MaaS and DX (digital transformation) trends accelerate, individual ownership of cars will decrease, and we expect the number of infrastructure-related vehicles devoted to moving people and goods to increase. In short, we think this shift in the main customers for tires from individuals to companies will increasingly turn consumer tires into commercial tires.

Responding to this change in the tire market, we will implement a growth strategy based on two separate approaches, which we refer to as "Exploitation" and "Exploration".

Consumer Tires: Raise High Value-Added Tire Sales Ratio

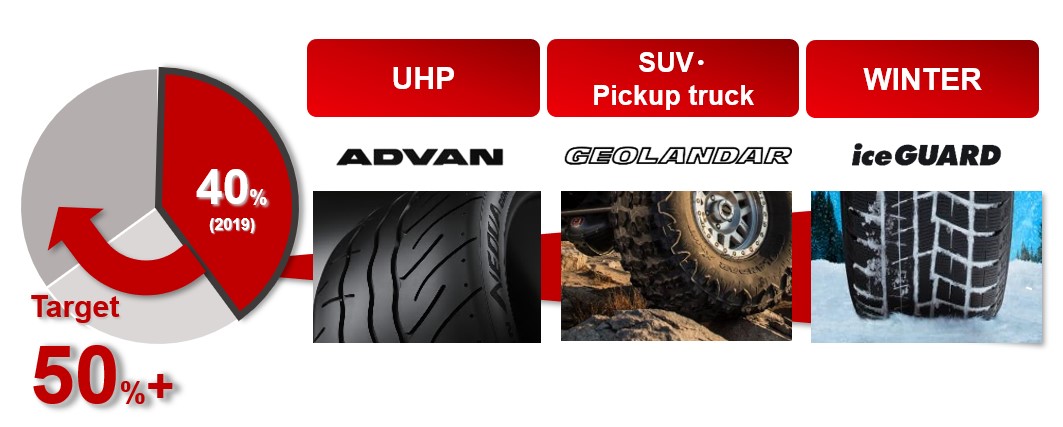

We aim to expand sales of our high-performance consumer tires, namely the ADVAN and GEOLANDAR brands as well as WINTER tires, and raise their share of our total tire sales from the current 40% to more than 50%.

- Expanding OE use of ADVAN & GEOLANDAR

- Strengthen sales in replacement market and Expand size lineups including for WINTER tires

- Strengthen sales of tires suited to local market needs

Strengthen core products and brands by leveraging original technologies and superior quality

Our efforts to achieve the above three goals will include bolstering product development of high value-added products and further strengthening our brand power.

OE tires for premium cars

As selection of a tire as original equipment on a premium car model is one indicator of that tire’s excellent technology, we will intensify our OE sales efforts.

Porsche Cayenne

Mercedes-AMG

Ram 1500

Jeep Compass

Strengthen WINTER tire R&D

We also are working to further enhance our winter tires’ ice and snow performance at our winter tire test centers in Hokkaido and Sweden. The test center in Hokkaido has an in indoor test site and in November last year bolstered its development capabilities by installing a new refrigeration system that enables it to test tire performance across a wide temperature range.

Tire Test Center of Hokkaido

New refrigeration system for indoor ice test site

YOKOHAMA TEST CENTER of SWEDEN

Motorsports Activities

We will again be supporting Walkenhorst Motorsport, a BMW customer team, as it aims for a second consecutive Nürburgring Endurance series championship in the top-level SP9 Pro class, and the overall victory in the Nürburgring 24-Hour Endurance Race.

In SUPER GT GT500, we aim to further strengthen our ADVAN brand by supporting two teams—one racing a Nissan and the other a Toyota, in their challenge to reach the winner’s podium. In off-road racing, we seek to further raise awareness of our GEOLANDAR brand through our support for teams participating in series races in North America and Asia.

Nürburgring 24-Hour Endurance Race

Nürburgring Endurance Series (NLS)

SUPER GT GT500

SUPER GT GT300

U.S. BlueWater Desert Challenge

Product & Regional Strategies

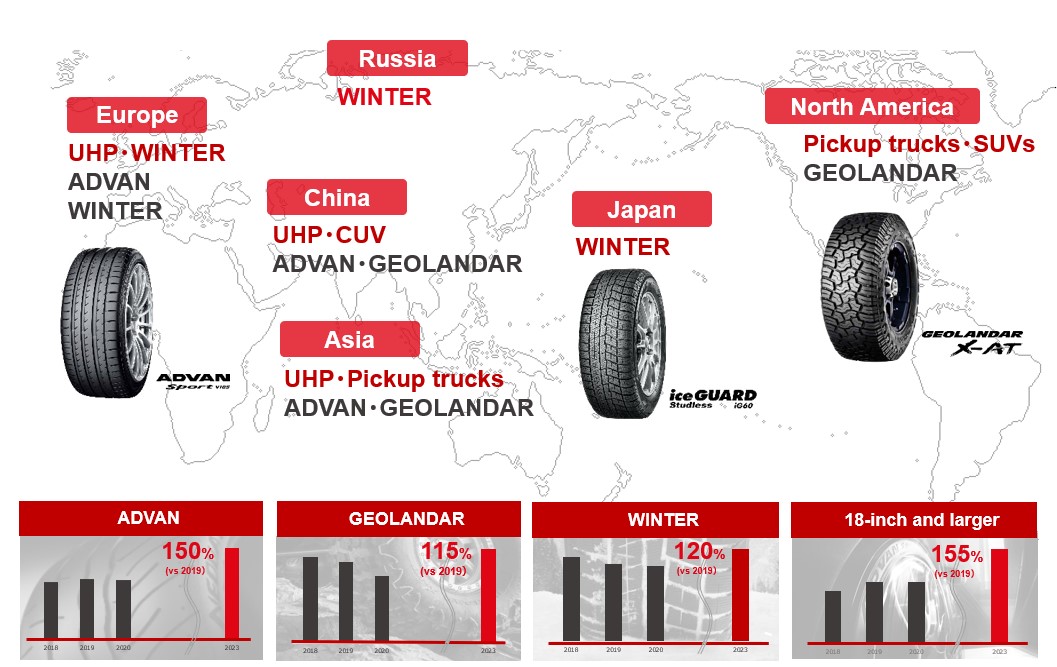

Our product and regional strategies will seek to expand sales of products that fit well with the market trends in each region. For example, in North America we will be focusing on sales of our GEOLANDAR tires for SUVs and pickup trucks. In Japan, we will be emphasizing sales of our studless winter tires, and in Europe we will seek to expand sales of our ultra-high performance ADVAN brand and our WINTER tires.

More specifically, we will strengthen our product development, supply, and sales systems in accordance with market trends in each region, as we aim to expand sales of the ADVAN brand by 50%, the GEOLANDAR brand by 15%, winter tires by 20%, and tire sizes of 18-inch and over by 55%.

Commercial Tires: Respond to Market Changes

We will be "Searching" for opportunities to create new value by capturing major market changes, such as the trends toward CASE, MaaS, and DX. We also plan to further accelerate growth of OHT business and TBR business.

Cost competitiveness

To meet the expected growth in demand for lower cost tires, we are positioning Yokohama India’s passenger car plant as the most cost-competitive passenger car plant in the Yokohama Rubber Group, as a first step in the revision of our production network with the aim of establishing a new low-cost model in tune with the tire market of the future. We also are considering using a similar low-cost model to increase output at our truck and bus tire plant in Thailand.

India PC plant

Thailand TBR plant

Service

With CASE and MaaS expected to increase corporate ownership of vehicles, we believe the value demanded from tire manufacturers will expand from the tires themselves to tire-related after-sales services, including tire replacement. We already have a sales and logistics network with locations in all of Japan's 47 prefectures, and we will leverage this network to strengthen our services to corporate customers.

More specifically, we will expand our fleet of service vehicles, which we use to provide tire replacement, tire checkups and other tire management services to such corporate customers as car dealers and companies operating car-sharing businesses. Going forward, we aim to provide more flexible and mobile services.

■Increasing fleet of service vehicles

DX: Digital Transformation

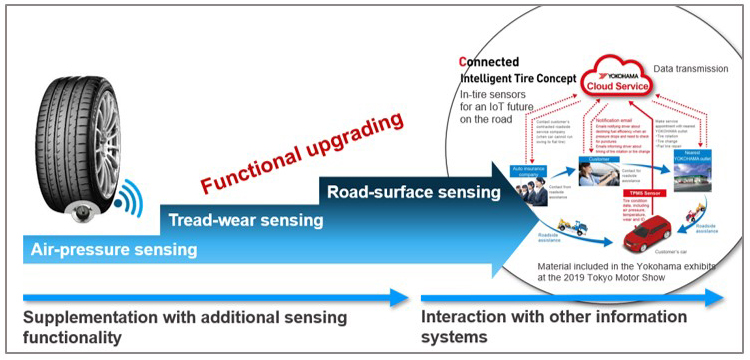

Applying digital technologies to tires to support enhanced information services is becoming an important trend. We are developing cutting-edge sensor-equipped tires and plan to add functions to the sensors to gradually increase the services and customers that can make use of these tires.

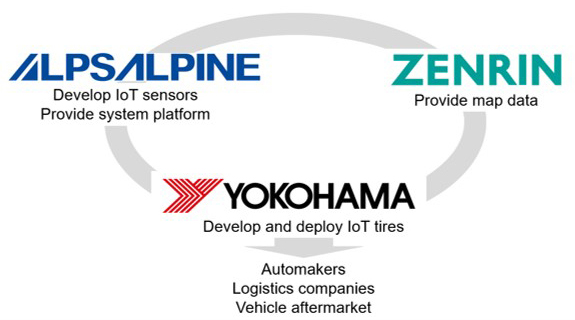

Toward that end, we are forming alliances with companies in different industries. For example, we are working with Alps Alpine and Zenrin on a trial operation of a system that links data obtained from tire sensors equipped with a road surface detection system with map information. We are considering using this system to create a new tire-related business.

Product Lineup

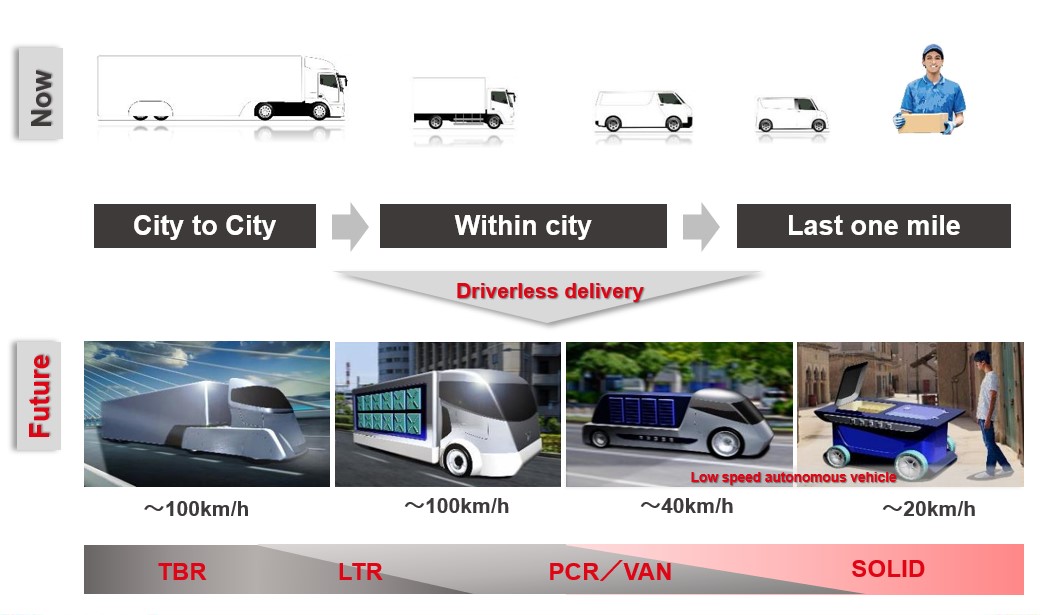

Today, deliveries are made by drivers operating a range of vehicles, from large trailer trucks to small trucks and vans. However, as vehicles become electric and self-driving, the transport of goods over long and short distances as well as the last one mile to the recipient’s door could well be accomplished without drivers. The diverse lineup of vehicles that run the logistics gauntlet in the future will need different types of tires. For example, last-mile vehicles may be fitted with punctureproof solid tires.

One of our strengths is being one of the few tire makers that has the full lineup of tires, from truck and bus tires to airless solid tires, that will be required by the expected change in the types of vehicles used to distribute goods in the future. And we will continue to broaden our product lineup to further strengthen this competitive advantage.

■Expected transformation of vehicles used in each stage of the distribution process

OHT Business is Future Growth Driver

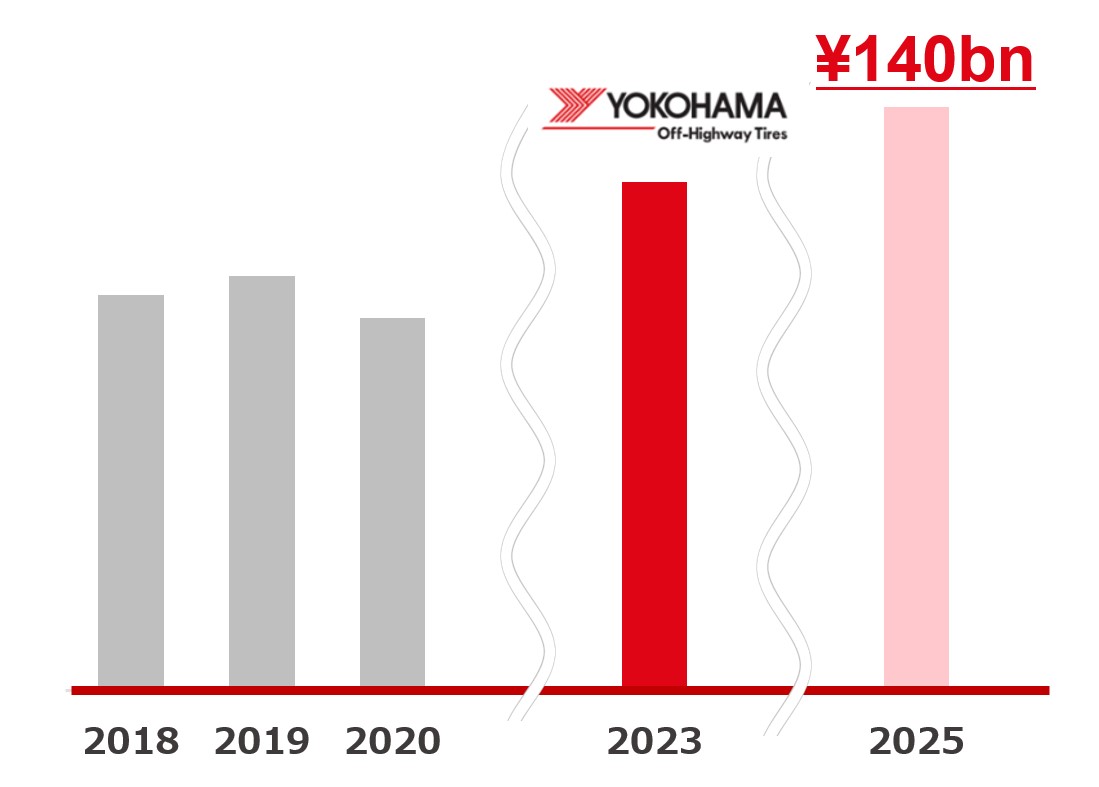

OHT business is positioned as the growth driver in our commercial tire segment. We have been strengthening the OHT business since acquiring ATG in 2016 and Aichi Tire in 2017.

Integrate OHT businesses of Yokohama Rubber, ATG, and Aichi Tire

We plan to further accelerate growth of this business during the new medium-term plan and in 2021 have begun to integrate the OHT operations of Yokohama Rubber, ATG and Aichi Tire.

Multi-brand strategy

The integrated business has a multi-brand lineup that includes YOKOHAMA, ALLIANCE, GALAXY, PRIMEX, and AICHI tires. We will use this product lineup to develop new markets, meet customers’ diverse needs, and therefore expand this business.

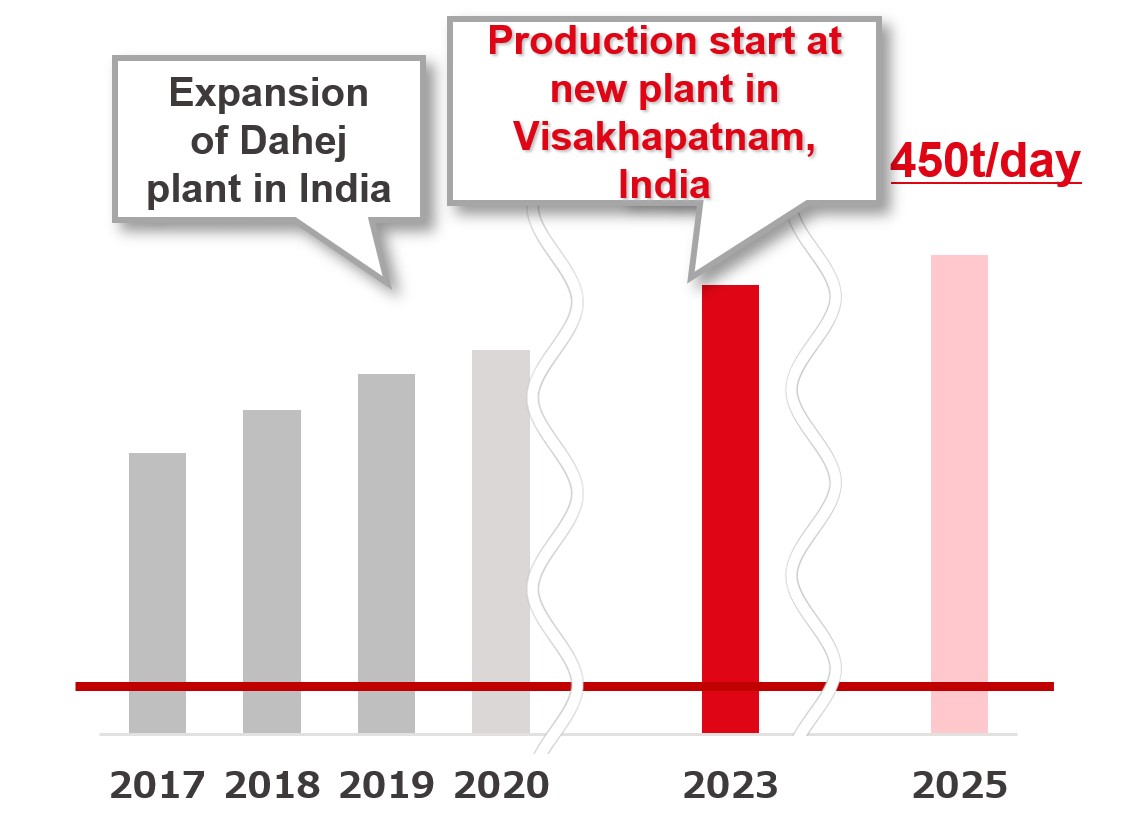

Increase production capacity: New plant in Visakhapatnam, India

We expect strong demand from the OHT market in the years ahead and will aggressively invest to expand our production capacity, such as the new plant now being built in Visakhapatnam, India. Through these initiatives, we aim to expand OHT sales revenue to ¥140 billion in 2025, accounting for 30% of Group revenues.

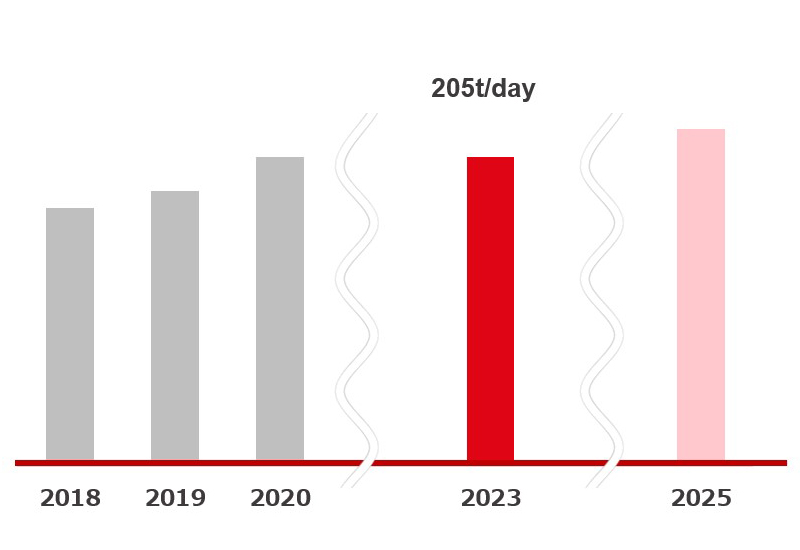

OHT production capacity (rubber volume)

OHT business sales revenue targets

TBR Business Strengthening Foundation for Future Growth

Sales in this business are already greater than our production capacity. We pursue two strategies below.

Secure stable supply from our Mississippi plant

We are working to secure stable supply from our Mississippi plant and create the infrastructure needed to fulfill demand.

US TBR plant

Invest in capacity expansion and increase sales

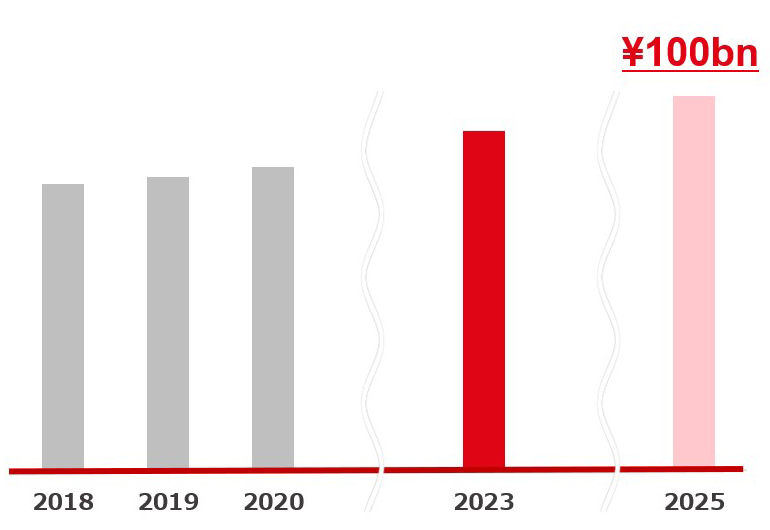

Expecting demand for TBR tires to continue expanding, we plan to invest to further boost capacity at our TBR plant as we target sales revenue of ¥100 billion in 2025.

TBR business production capacity (rubber volume)

TBR business sales revenue targets