News Release

Yokohama Rubber Posts Record Sales, Earnings for 2022

2023.February.17

- Management relation

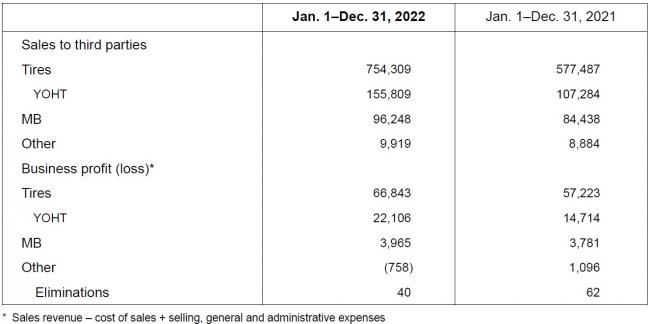

Hiratsuka, Japan—The Yokohama Rubber Co., Ltd., announced today its business and financial results for fiscal 2022 (January to December 2022). Sales revenue increased 28.3% over the previous year, to 860.5 billion yen, and business profit increased 12.8%, to 70.1 billion yen. Both of those figures were record-high figures for full-year performance at Yokohama Rubber. Profit on the sale of Yokohama Rubber’s headquarters building in the previous year and other factors resulted in declines in operating profit, which declined 17.7%, to 68.9 billion yen, and in profit attributable to owners of parent, which declined 29.9%, to 45.9 billion yen.

* Business profit is equivalent to operating income under accounting principles generally accepted in Japan and consists of sales revenue less the sum of cost of sales and selling, general and administrative expenses

The record-high figures for sales revenue and business profit reflected a successful summer campaign for promoting sales of ADVAN-brand high-value-added products and vigorous business in of agricultural tires and other off-highway tires. They also reflected improvements in Yokohama Rubber’s product mix and price increases in Japan and overseas markets. The positive factors resulted in notably strong sales gains in North America. Sales and earnings also benefited from the weakening of the yen during the year against other principal currencies.

Yokohama Rubber’s strong business performance overcame several adverse factors, starting with the fallout from the conflict in Ukraine. The adversity also included upturns in raw material prices and logistics costs, reduced production by automakers on account of the shortages of semiconductor components, China’s zero-Covid policy, and the inflation-caused surge in energy prices.

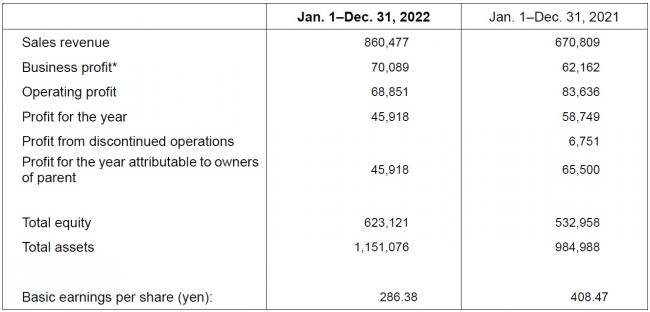

Both sales revenue and business profit increased over the previous year in Yokohama Rubber’s Tires segment. The company’s sales of original equipment tires increased as automakers began moving to restore production volume, as Yokohama Rubber won new fitments in North America, and as the yen weakened against other principal currencies. Those factors more than offset the continuing constraints imposed on vehicle production by the shortages of semiconductor components and the adverse effects of the Covid-related lockdowns in China.

Yokohama Rubber also posted sales growth in replacement tires. Heavy snowfalls in Japan in early 2022 stimulated sales of Yokohama Rubber’s winter tires, and successful promotion of high-value-added products in overseas markets fueled sales momentum in North America and in China and other Asian nations. Sales revenue in replacement tires also benefited from price increases in several markets, though the contribution from price increases was less than planned in Japan.

The company posted record-high sales revenue and business profit in its Yokohama Off-Highway Tires unit (formerly the ATG [Alliance Tire Group] segment). That strong performance reflected success in asserting the cost competitiveness of the unit’s Indian-produced tires through North American and other sales channels and success in securing price increases for the unit’s products.

* Yokohama Rubber has absorbed the ATG segment into its Tires segment as of fiscal 2022. That is on account of similarities between the two segments in regard to customers and product characteristics.

Sales revenue and business profit also increased over the previous year in Yokohama Rubber’s MB segment. Business in high-pressure hoses expanded, supported by the recovery in vehicle production in North America and by resilient Japanese demand for hydraulic hoses for construction equipment and other applications. Sales increased, too, in industrial materials, as Yokohama Rubber posted robust growth in Japanese business in conveyor belts and demand for replacement fixtures and components recovered in the commercial aircraft sector.

* Yokohama Rubber absorbed its business in aerospace products into the industrial products division on March 30, 2022.

Management projects that full-year sales and earnings will again attain record-high levels in fiscal 2023. Its projections call for a 4.6% increase in sales revenue, to 900.0 billion yen; a 4.2% increase in business profit, to 73.0 billion yen; a 6.0% increase in operating profit, to 73.0 billion yen; and a 0.2% increase in profit attributable to owners of parent, to 46.0 billion yen. Management will recommend paying a year-end dividend of 34 yen per share and plans to declare an interim dividend of 33 yen per share, which would result in an annual dividend 67 yen per share.

Medium-term management plan YX2023: Progress in FY2022 and main activities in FY2023

Under Yokohama Transformation 2023 (YX2023), the company’s medium-term management plan for fiscal years 2021–2023, Yokohama Rubber is simultaneously promoting the “exploitation” of the strengths of its existing businesses and the “exploration” of new value that will meet the needs of customers and society in an era of great change, as the company strives for “transformation” that will drive growth over the next generation.

Consumer tires

The consumer tire business is aiming to expand the sales ratio of high value-added tires from 40% in 2019 to more than 50% by increasing sales of its ADVAN, GEOLANDAR, and WINTER tires. Toward that end, the business has been making efforts to expand use of ADVAN and GEOLANDAR brand tires as original equipment (OE), strengthen sales in the replacement market, expand size lineups, including for WINTER tires, and strengthen sales of tires suited to local market needs.

In 2022, the effort to expand sales of OE tires for use on premium cars and electric vehicles (EVs) resulted in YOKOHAMA tires becoming OE on several new models from leading automobile makers, including Mercedes-AMG’s first EV; BMW M GmbH’s high-performance models; Toyota Motor Corporation’s Lexus LX and Lexus RX; the new Nissan Z from Nissan Motor Co., Ltd.; and Subaru Corporation’s EV, the SOLTERRA. During fiscal 2022’s “YOKOHAMA New Summer” campaign, the consumer tire business expanded sales of new tires, such as ADVAN Sport V107 and ADVAN NEOVA AD09, to the replacement tire market. Motorsports activities during the year included winning the GT300 class series championship of SUPER GT Series and the overall championship at the 100th Pikes Peak International Hill Climb and the Asia Cross Country Rally. These activities increased the sales ratio of high value-added tires to 42%.

In fiscal 2023, the consumer tire business will strive to expand sales of its GEOLANDAR tires under a new “Mud Match” themed sales campaign. In the 45th year since the launch of the ADVAN brand, the consumer tire business will take on a number of challenges to expand brand sales and boost the sales ratio of its high value-added tires to 47%. It began supplying ADVAN APEX V601 tire as OE for Toyota Motor’s new GR Corolla, and it also plans to launch new ADVAN tires for EVs. In addition, Yokohama Rubber is responding to strong growth in the robust India market and plans to expand its passenger car tire production capacity in India to 4.5 million tires by the fourth quarter of 2024, a 2.9-fold increase from 1.53 million in 2019.

Commercial tires

The commercial tire business continues to explore opportunities created by market changes, with a focus on four themes—cost, service, digital transformation (DX), and strengthening its product lineup.

In the off-highway tire (OHT) business, considered a key driver of future growth, YOHT began production ahead of schedule in August at its new Visakhapatnam Plant in India. The truck and bus (TBR) business continued to improve the supply capability of its Mississippi Plant in the United States, achieving record high production volume at the plant in 2022. In addition, the company invested to expand production of ultrawide base 903W tires and all-season BluEarth 711L tires at Mie Plant.

In 2023, the OHT business will operate the Visakhapatnam Plant at full capacity and proceed with the second stage of the plant’s expansion. The company also is making an additional investment to expand production of truck and bus tires including tires for light trucks at its Mie Plant in Japan. The investment will add 100,000 tires to the plant’s annual production capacity. In addition, the acquisition of Trelleborg Wheel Systems Holding AB is now scheduled to be completed in the first half of 2023, after completion of compliance law reviews required by all concerned countries.

MB businesses

MB segment resources are being concentrated in its two strongest businesses—hose & couplings and industrial products—in order to transform the segment into a generator of stable earnings. In 2022, the hose & couplings business progressed with the reorganization of its automotive hoses & couplings production network in US and Mexico. In the hydraulic hose area, the company decided to invest to expand production capacity at its Ibaraki Plant in Japan in addition to its plans to expand production at its plant in China. The industrial products business expanded its share of the conveyor belt market in Japan to nearly 50% in 2022 and has begun work to expand production capacity at its Hiratsuka Factory. As part of the effort to secure stable earnings by concentrating resources in the MB segment’s two core business, the aerospace products division was integrated into the industrial products division in 2022.

In 2023, the hose & couplings business will further raise its Mexico plant’s share of total output to 31% and expand hydraulic hose production capacity at its plant in China. The industrial products business will continue its efforts to maximize its share of the conveyor belt market in Japan and plans to launch new products as part of that effort.

ESG activities in 2022 and plans for 2023

Yokohama Rubber regards ESG activities as an important strategy that will contribute to the strengthening of its business and lead to sustainable increases in its corporate value.

Yokohama Rubber’s environment-related initiatives are based on a three-pillar strategy focused on achieving carbon neutrality, a circular economy, and coexistence with nature, which will support the achievement of the first two goals. The company is targeting net zero CO2 emissions and 100% use of sustainable materials by 2050. In 2022, Yokohama Rubber undertook initiatives to make its Shinshiro-Minami Plant carbon neutral and realize the use of racing tires made from sustainable materials, while continuing nature-positive tree-planting activities. Social-related initiatives included the formulation of a human rights policy and expansion of the company’s grievance redress mechanisms based on the JaCER (Japan Center for Engagement and Remedy on Business and Human Rights) platform. Corporate governance–related initiatives included the unwinding of cross-shareholdings and promoting governance diversity by, for example, appointing a female outside director. The company’s ESG activities were again highly evaluated, as it was named to the CDP’s Climate Change A List and received four stars in the Nikkei SDGs Management Survey.

In 2023, Yokohama Rubber will continue its efforts to reduce energy consumption at its production bases in Japan and overseas. It will also launch new carbon-neutral tires and continue its research and development of tires using sustainable materials. The Company also will raise its initiatives to solve environmental issues to the next level by setting new short- and medium-term goals for its biodiversity conservation activities. In addition, Yokohama Rubber will further strengthen its corporate governance and address social issues by accelerating work-style reforms and transitioning to a company with an Audit & Supervisory Committee.

Financial Highlights (Millions of yen)

Results by Business Segment (Millions of yen)