News Release

Sales revenue and business profit up at Yokohama Rubber in first half of 2022

2022.August.10

- Management relation

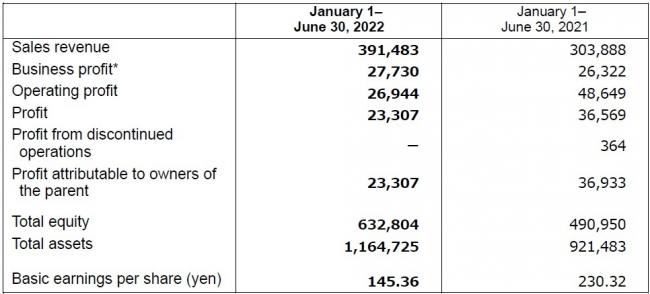

Tokyo—The Yokohama Rubber Co., Ltd., announced today its business and financial results for the first half (January to June) of fiscal 2022. Profit attributable to owners of parent declined 36.9% from the same period of the previous year, to 23.3 billion yen, on a 44.6% decline in operating profit, to 26.9 billion yen; a 5.3% increase in business profit, to 27.7 billion yen; and a 28.8% increase in sales revenue, to 391.5 billion yen.

*Business profit is equivalent to operating income under accounting principles generally accepted in Japan and consists of sales revenue less the sum of cost of sales and selling, general and administrative expenses

Yokohama Rubber’s gains in sales revenue and in business profit reflected robust growth in overseas sales of tires, including off-highway tires for agricultural machinery and industrial machinery, and the weakening of the yen against other principal currencies. Those positive factors more than offset the adverse effects of the prolonged Russia-Ukraine crisis, the rising cost of raw materials and logistics, and declines in unit production by automakers.

First-half sales revenue and business profit in Yokohama Rubber’s Tires segment increased over the same period of the previous year. Sales revenue in original equipment tires increased, supported by Yokohama Rubber’s success in winning new equipments in North America and China and by the weakening of the yen. The sales growth in original equipment tires occurred despite the adverse effects of shortages of semiconductor devices on vehicle production volume worldwide and of the lockdowns in China occasioned by outbreaks of Covid-19.

Sales revenue increased in replacement tires for passenger vehicles and commercial vehicles. Business was robust in Japan, where it benefited from early-year snowfalls and resultant vigor in sales of winter tires. In overseas business in replacement tires, Yokohama Rubber achieved sales growth in North America and in China, India, and other Asian markets by promoting high-value-added products and by responding effectively to robust demand.

Yokohama Rubber posted solid growth in off-highway tires for agricultural machinery, industrial machinery, and other applications. The company has transferred that business, formerly handled as the ATG (Alliance Tire Group) segment, to the Tires segment in 2022. It handles that business in the Tires segment as the Yokohama Off-Highway Tires unit.

Sales revenue also increased over the same period of the previous year in Yokohama Rubber’s MB (Multiple Business) segment. Business profit declined in that segment, however, on account of the rising cost of raw materials and the tight labor market in the United States. Sales revenue in hose & couplings increased, driven by strong sales of hydraulic hoses for construction equipment in Japan and overseas. Sales revenue increased in industrial materials. Yokohama Rubber stepped up its Japanese marketing of conveyor belts and achieved strong sales overall. Sales increased in aircraft fixtures and components, reflecting a recovery in replacement demand in the commercial aircraft sector. Yokohama Rubber folded its aircraft fixtures and components business into its industrial materials business unit on March 30, 2022.

Yokohama Rubber has revised upward the full-year fiscal projections for 2022 sales and earnings that it announced in February. Yokohama Rubber’s revised projections calls for sales revenue of 855.0 billion yen, up 14.0% over the earlier projection, business profit of 62.5 billion yen, up 4.2%, operating profit of 60.5 billion yen, up 3.4%, and profit attributable to owners of parent of 42.0 billion yen, up 5.0%. Management has declared an interim dividend of 33 yen per share and plans to recommend a year-end dividend of 33 yen per share. That would result in a 1 yen increase in the aggregate, full-year dividend, at 66 yen.

Progress of YX2023 medium-term management plan

Under Yokohama Transformation 2023 (YX2023), the company’s medium-term management plan for fiscal years 2021–2023, Yokohama Rubber is simultaneously promoting the “exploitation” of the strengths of our existing businesses and the “exploration” of new value that will meet the needs of customers and society in an era of great change, as the company strives for "transformation" that will drive growth over the next generation.

The consumer tire business is aiming to maximize the sales ratio of its high-value-added tires during YX2023. Toward that end, the business has been making efforts to expand sales of its ADVAN and GEOLANDAR brands as well as its WINTER tires.

Recent successes in the original equipment (OE) market for premium cars and EVs have included the adoption of ADVAN V61 tires as OE on two new battery electric vehicles (BEVs)—Toyota Motor Corporation’s bZ4X and Subaru Corporation’s SOLTERRA.

The consumer tire business also is strengthening marketing to the replacement tire market under this year’s “YOKOHAMA New Summer”. This effort has generated strong results focused on the marketing of four recent additions to YOKOHAMA’s tire lineup: the ADVAN Sport V107, a new global flagship tire; the ADVAN NEOVA AD09, a high-performance street tire; the BluEarth-RV RV03, a fuel-efficient tire for minivans; and the BluEarth-RV RV03CK, a fuel-efficient tire for compact minivans and light box wagons.

Meanwhile, Yokohama Rubber’s motorsports activities continue their winning ways, with the most recent accomplishment coming at the 100th Pikes Peak International Hill Climb, where a car running on YOKOHAMA tires captured the overall championship for the second time in the past three years.

The commercial tire business is exploring opportunities created by market changes, with a focus on four themes—cost, service, digital transformation (DX), and strengthening its product lineup.

In March, Yokohama Rubber reached an agreement with Sweden’s Trelleborg AB to acquire all outstanding shares of Trelleborg Wheel Systems Holding AB, and it is now working toward completing the acquisition as scheduled in the latter half of this year. The acquisition will be funded by a combination of cash-on-hand and new borrowings, and after the deal was announced the Japan Credit Rating Agency, Ltd., reconfirmed its A+ rating on Yokohama Rubber in consideration of the company’s cash-flow generation capacity.

Based on its capital allocation policy, Yokohama Rubber has been selling off real estate and cross-shareholdings, including the sale of its head office building in Tokyo’s Minato Ward in March 2021. The cash generated by these sales has bolstered the management resources being used for M&A and other activities supporting entry into areas expected to drive future growth.

In the MB segment, Yokohama Rubber is continuing to concentrate its resources in the segment’s two strongest businesses—hose & couplings and industrial products—as it seeks to transform the segment into a generator of stable earnings. Accordingly, Yokohama Rubber is expanding its high-pressure hydraulic hose production capacity at plants in Japan and abroad, reorganizing the production of automotive hose & couplings at its plants in North America, and increasing conveyor belt production capacity at its Hiratsuka Factory.

On the ESG front, Yokohama Rubber is implementing environment-related initiatives based on a three-pillar strategy focused on achieving carbon neutrality, a circular economy, and coexistence with nature. As part of the effort to realize a circular economy, Yokohama Rubber is developing tires using sustainable materials, and a car equipped with ADVAN A052 tires made from sustainable materials successfully completed the 100th Pikes Peak International Hill Climb with a sixth place finish in the Exhibition Division. In addition, Yokohama Rubber’s R&D into rubber materials using sustainable resources was recognized when two of the company’s researchers received 34th Awards of the Japan Society of Rubber Science and Technology.

Under YX2023, Yokohama Rubber is promoting the use of digital technology, including artificial intelligence (AI) and sensor technology. To accelerate this digital transformation, the company has established the “YOKOHAMA Digital Strategy.” The new strategy includes initiatives in three core pillars: (1) “Exploitation” initiatives targeted at strengthening competitiveness by improving processes, (2) “Exploration” initiatives targeting the creation of new value and services for customers, and (3) initiatives to reform Yokohama Rubber’s corporate culture, with a focus on work-style reforms. These issues promoting Yokohama Rubber’s digital transformation will enhance its corporate value and generate a sustainable transformation that will propel future growth.

Financial Highlights (Millions of yen)

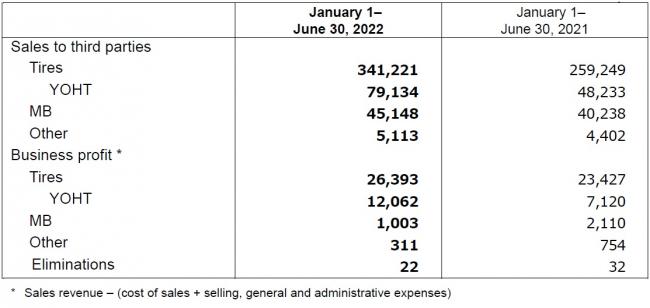

Results by Business Segment (Millions of yen)