News Release

Yokohama Rubber Announces First-Half Fiscal Results

Company posts highest-ever first-half results

2021.August.11

- Management relation

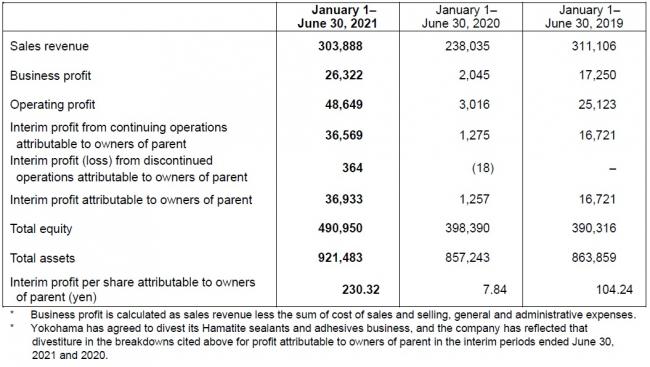

Tokyo—The Yokohama Rubber Co., Ltd., announced today its business and financial results for the first half (January to June) of fiscal 2021. Profit attributable to owners of parent increased approximately 29-fold over the same period of the previous year, to 36.9 billion yen, on an approximately 16-fold increase in operating profit, to 48.6 billion yen; an approximately 13-fold increase in business profit, to 26.3 billion yen; and a 27.7% increase in sales revenue, to 303.9 billion yen. All of the earnings figures were Yokohama’s highest ever for the fiscal first-half. Leading the growth in sales and earnings for Yokohama was resurgent momentum in tires in Japan and overseas.

* Business profit is basically equivalent to operating income under accounting principles generally accepted in Japan and calculated as sales revenue less the sum of cost of sales and selling, general and administrative expenses.

* Yokohama has agreed to divest its Hamatite sealings and adhesives business. The company has reclassified that business as “discontinued operations” in the interim results reported here and has restated the figures for the same period of the previous year in accordance with that reclassification.

First-half sales revenue and business profit in Yokohama’s Tires segment increased over the same period of the previous year. Sales revenue in original equipment tires increased strongly, supported by recovering demand in Japan and in China. That increase occurred despite the adverse effect of shortages of semiconductor devices on vehicle production volume worldwide. In replacement tires, sales revenue rose strongly in Japan and overseas. That growth was testimony to vigorous promotion of high-value-added products and expanded production to meet robust demand. Early-year snowfalls in Japan supported strong sales of winter tires there.

Yokohama also posted growth over the same period of the previous year in first-half sales revenue and business profit in its MB (Multiple Business) segment. Sales revenue in hose & couplings rose in Japan and overseas. Markets rebounded despite the adverse effects of the global shortages of semiconductor devices, and Yokohama recorded sales growth in hoses for construction equipment and for automobiles. Yokohama’s sales revenue in industrial products declined from the same period of the previous year. That decline occurred despite sales vigor in conveyor belts and reflected weakness in civil engineering products and in marine hoses and other products for the marine equipment market. In aircraft fixtures and components, sales revenue was down on account of declines in demand in the commercial and government sectors.

Sales revenue and business profit in Yokohama’s ATG (Alliance Tire Group) segment increased to their highest-ever levels. The ATG segment centers on business in off-highway tires for agricultural machinery and for industrial machinery, and the strong first-half performance reflected robust demand in those product categories.

Yokohama has revised upward the full-year fiscal projections for 2021 that it announced in May. Those projections call for sales revenue of 655.0 billion yen (up 2.3% over the May projection), business profit of 51.5 billion yen (up 3.0%), operating profit of 73.5 billion yen (up 2.8%), and profit attributable to owners of parent of 57.5 billion yen (up 2.7%).

Medium-term Plan YX2023 and Main Activities in Each Business

Under Yokohama Transformation 2023 (YX2023), the Company’s medium-term management plan for fiscal years 2021–2023, Yokohama Rubber is simultaneously promoting the “exploitation” of the strengths of our existing businesses and the “exploration” of new value that will meet the needs of customers and society in an era of great change, as the Company strives for transformation that will drive growth over the next generation. Under YX2023, Yokohama Rubber aims to achieve record sales revenue of 700 billion yen and business profit of 70 billion yen in fiscal 2023.

The Tire Business aims to maximize the sales ratio of its high-value-added tires during YX2023. In line with that objective, the Business is taking actions to expand sales of its ADVAN and GEOLANDAR brands as well as its winter tires. Major accomplishments thus far in 2021 include the recognition of Yokohama Rubber’s excellent tire technologies by a number of premium car makers in Japan and overseas, which led to the selection of Yokohama tires as original equipment for premium models by BMW and Mercedes-AMG. In addition, the Tire Business launched two new winter tires—the iceGUARD 7 studless tire for passenger cars and the 904W studless tire for trucks and buses. Meanwhile, motorsports activities included the provision of ADVAN and GEOLANDAR tires to teams competing in events in Japan and overseas, including SUPER GT races, the Nürburgring Endurance Series, and off-road races in the United States and Mexico.

The MB segment is concentrating resources in its two strongest businesses—hose & couplings and industrial products—as it aims to transform into a unit that can generate stable earnings by shifting to a product portfolio with highly stable earnings and strong growth potential. The segment’s main activities thus far in 2021 include expanding production capacity at its Chinese hoses and fittings plant and acquiring a Hokkaido-based company engaged in the maintenance of construction and hydraulic machinery. MB segment efforts on the product front included the development of a lightweight automotive air-conditioning hose that will contribute to lighter automobiles when it launches full-scale production and sales of the new hose in 2024. Meanwhile, the Company decided to transfer the MB segment’s Hamatite business to Switzerland’s Sika AG. The transfer is scheduled for November 1.

The OHT business is positioned as a future growth driver. To help realize this goal, Yokohama Rubber merged its OHT business with those of group subsidiaries ATG and Aichi Tire into a newly established global group subsidiary named Yokohama Off-Highway Tires (YOHT). YOHT will endeavor to expand the Group’s global OHT business by capitalizing on the strength of a multi-brand lineup that includes YOKOHAMA, ALLIANCE, GALAXY, PRIMEX, and AICHI brand OHTs to develop new markets and meet diverse customer needs. At the same time, YOHT is expanding OHT production capacity to further enhance global competitiveness. The newly integrated business’ efforts led to the delivery of OHT tires from the Yokohama Group to a major Japanese maker of agricultural machinery for the first time in nearly 50 years. YOHT also decided to make an additional investment to expand the production capacity of a new OHT plant now under construction in India by 2.2 times over the initial plan.

Financial Highlights (Millions of yen)

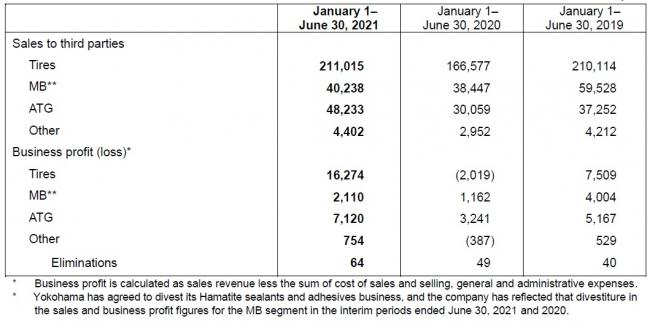

Results by Business Segment (Millions of yen)