News Release

Yokohama Rubber Releases Full-Year Fiscal Results for 2020

Company posts record high earnings in fourth quarter

2021.February.19

- Management relation

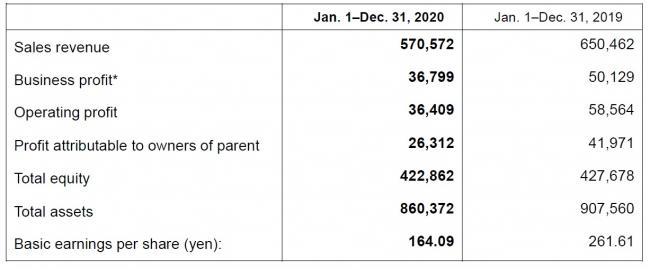

Tokyo - The Yokohama Rubber Co., Ltd., announced today its business and financial results for fiscal 2020 (January to December 2020). Sales revenue declined 12.3% from the previous year, to 570.6 billion yen; business profit* declined 26.6%, to 36.8 billion yen; operating profit declined 37.8%, to 36.4 billion yen; and profit attributable to owners of parent declined 37.3%, to 26.3 billion yen.

*Basically equivalent to operating income under accounting principles generally accepted in Japan and calculated as sales revenue less the sum of cost of sales and selling, general and administrative expenses

Yokohama reversed the downward trend in earnings in the fourth quarter (October to December) and posted record-high October-December figures for business profit, operating profit and profit attributable to owners of parent. The upturn in profitability reflected improvements in the company’s structure of earnings, including reductions in fixed costs and an overall improvement in production costs. The upturn in profitability also reflected the successful tailoring of marketing to regional circumstances and to trends in demand, increased production output, and strong Japanese sales of winter tires.

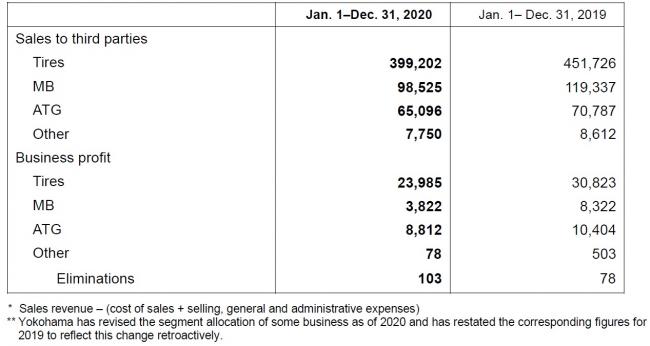

In Yokohama’s Tires segment, full-year sales revenue and business profit were down from the previous year, but original equipment business in Japan displayed gradual improvement in the fiscal second half, and full-year sales in China increased over the previous year. Yokohama worked to buttress sales in replacement tires through the promotion of high-value-added products and other stratagems, and sales of winter tires were robust in the fourth quarter. The COVID-19 pandemic affected business severely in the fiscal first half, however, and full-year sales declined in original equipment tires and in replacement tires.

Sales revenue and business profit declined in the MB (Multiple Business) segment as the COVID-19 pandemic affected business adversely in every product category. Business in high-pressure hoses declined, reflecting a first-half downturn in demand. In industrial materials, sales revenue declined as business slumped in Japan and overseas. Sales revenue declined in Hamatite-brand sealants and adhesives, reflecting a sharp downturn in demand in the first half. In aircraft fixtures and components, sales revenue declined on account of weakness in the commercial sector.

Business in Yokohama’s ATG segment suffered from the adverse effect of COVID-19 pandemic on demand worldwide. The ATG segment comprises business in off-highway tires for agricultural machinery, industrial machinery, and other applications. Signs of a recovery appeared in replacement demand for agricultural equipment tires, and ATG sales revenue were higher in the second half than in the same period of the previous year.

The COVID-19 pandemic continues to weigh on business performance in 2021, but demand is recovering in some regions. Yokohama’s full-year fiscal projections for 2021 call for sales revenue of 620.0 billion yen, up 8.7% over the previous year; business profit of 50.0 billion yen, up 35.9%; operating profit of 50.5 billion yen, up 38.7%; and profit attributable to owners of parent of 34.5 billion yen, up 31.1%. Management will recommend raising the year-end dividend 1 yen, to 33 yen. That, together with the interim dividend of 32 yen, would raise the annual dividend 1 yen, to 65 yen.

Financial Highlights (Financial Highlights )

Results by Business Segment (Millions of yen)**