News Release

Yokohama Rubber Announces Fiscal Results for First Quarter of 2020

2020.May.22

- Management relation

Tokyo—The Yokohama Rubber Co., Ltd., announced today its business and financial results for the first quarter (January to March) of fiscal 2020. Yokohama posted a 258 million yen loss attributable to owners of parent, compared with 9.1 billion yen in profit attributable to owners of parent in the same period of the previous year, on a 90.4% decline in operating profit, to 1.2 billion yen, and a 68.8% decline in business profit*, to 1.8 billion yen. Sales revenue declined 13.6%, to 129.1 billion yen.

*Equivalent to operating income under accounting principles generally accepted in Japan and calculated as sales revenue less the sum of cost of sales and selling, general and administrative expenses

In Yokohama’s Tires segment, sales revenue and business profit declined. The downturn in business profit reflected a decline in unit sales volume, an increase in production costs associated with reduced production volume, and inventory-adjustment costs occasioned by a tire recall in North America.

Yokohama’s sales revenue in original equipment business declined in Japan and overseas. That decline reflected production adjustments necessitated by a decline in Japanese demand associated with the novel coronavirus (COVID-19) outbreak and by suspended operation at vehicle plants in overseas markets.

Sales revenue also declined in replacement tires. Sales of winter tires in Japan were weak on account of warmer-than-usual winter temperatures at the outset of the year, and Japanese business in replacement tires also suffered from the adverse effect of the COVID-19 outbreak on consumer spending. Business in replacement tires was generally sluggish in overseas markets, too.

Sales revenue and business profit also declined in the MB (Multiple Business) segment. The COVID-19 outbreak affected business severely in each product category. Sales revenue declined in high-pressure hoses as demand declined worldwide in the construction equipment sector and as automotive business slumped on account of suspended operations at vehicle plants in several nations. Yokohama also posted a decline in sales revenue in industrial materials as deteriorating market conditions undermined business in conveyor belts, civil engineering products, and marine products. Sales declined in Yokohama’s Hamatite-brand sealants and adhesives as COVID-19 occasioned the suspension of work in several urban redevelopment projects in Japan and as automotive demand shrank worldwide. Sales revenue declined, too, in aircraft fixtures and components, reflecting delays in public-sector business.

Yokohama posted declines in sales revenue and business profit in the ATG segment. That segment comprises business in tires for agricultural machinery, for industrial machinery, and for other off-highway applications. The sales and earnings declines reflected the COVID-19 impact on demand worldwide.

The massive business disruption caused by COVID-19 will necessitate revisions in the full-year fiscal projections that Yokohama issued in February 2020. However, the full extent of that disruption is impossible to determine at this time, and the company will therefore withhold for the time being the release of revised business projections and of proposed dividends. Yokohama will release its revised business projections and proposals for dividends as soon as management secures a firm grasp of the fiscal outlook.

Several measures are under way at Yokohama to maintain a sound financial position in the face of the COVID-19 challenge. Those measures include fortifying short-term liquidity through optimal fund raising, paring cash expenditures by deferring capital spending and trimming costs, and reducing compensation for directors, officers, associate officers, and managers.

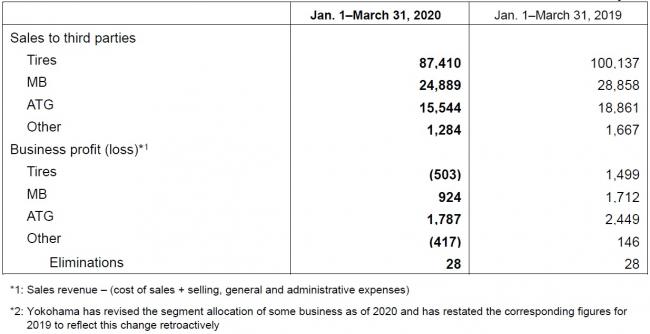

Financial Highlights (Millions of yen)

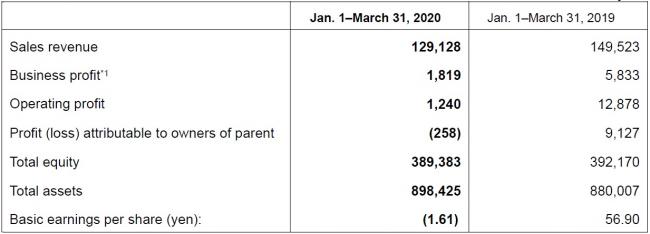

Results by Business Segment *2 (Millions of yen)