News Release

Yokohama Rubber Posts Record Earnings in 2019—Company to raise year-end dividend 2 yen

2020.February.14

- Management relation

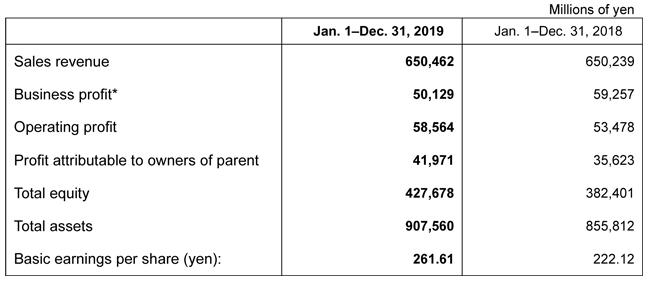

Tokyo—The Yokohama Rubber Co., Ltd., announced today its business and financial results for fiscal 2019 (January to December 2019). Sales revenue edged up slightly over the previous year, to 650.5 billion yen. Business profit* declined 15.4%, to 50.1 billion yen. Operating profit increased 9.5%, to 58.6 billion yen, and profit attributable to owners of parent increased 17.8%, to 42.0 billion yen.

*Equivalent to operating income under accounting principles generally accepted in Japan and calculated as sales revenue less the sum of cost of sales and selling, general and administrative expenses

Yokohama’s strong growth in operating profit reflected a first-quarter gain on the sale of fixed assets. Profit attributable to owners of parent benefited additionally from a third-quarter credit for the effect of a corporate tax–rate reduction in India. That reduction diminished a tax liability incurred in connection with an operational restructuring in the company’s ATG (Alliance Tire Group) segment. Sales revenue and profit attributable to owners of parent reached their highest levels ever at Yokohama. Management has recommended raising the year-end dividend 2 yen, to 33 yen per share. That would increase the annual dividend to 64 yen.

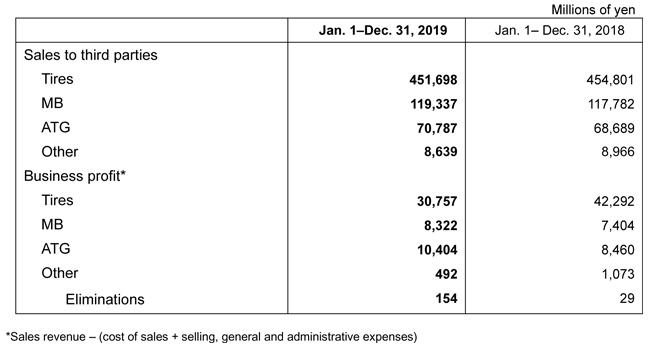

Sales revenue and business profit declined in Yokohama’s Tires segment. The decline in business profit reflected increased logistics expenses and the appreciation of the yen, as well as the decline in sales revenue. Sales revenue declined in original equipment business. In Japan, business in original equipment tires suffered from product changeovers for vehicle models equipped with Yokohama tires. Overseas business in original equipment was weak in most markets except North America.

Yokohama posted sales growth in replacement tires. Business there benefited from strategic initiatives under the company’s medium-term management plan, Grand Design 2020 (GD2020). That included promoting vigorously the premium-grade tires of Yokohama’s global flagship brand, ADVAN; the fuel-saving tires of the company’s BluEarth series; GEOLANDAR tires for sport-utility vehicles and pickup trucks; and other high-value-added products. In Japan, consecutive warm winters affected sales of winter tires adversely at the beginning and end of the year. Sales of summer tires were robust, and Yokohama maintained unit sales of replacement tires at the same level as in the previous year. Business declined, however, in sales value. Business in replacement tires was generally solid in overseas markets.

In the MB (Multiple Business) segment, sales revenue and business profit increased. Business in high-pressure hoses declined slightly despite overseas sales growth in automotive hoses. Demand for high-pressure hoses for construction equipment was weak in China and, on account of the effect of typhoon damage, in Japan. Business expanded in industrial materials, led by vigor in conveyor belts in Japan and overseas. Sales were flat in Hamatite sealants and adhesives. Japanese business in construction sealants was robust, spurred by demand in urban redevelopment projects. Business was stagnant, however, in automotive sealants and adhesives. In aircraft fixtures and components, business was vibrant in replacement lavatory modules for commercial aircraft, and sales increased in the commercial and government sectors.

Yokohama recorded growth in sales revenue and business profit in the ATG segment, which handles off-highway tires for agricultural machinery, industrial machinery, and other applications. Business was especially strong in replacement tires.

Management’s full-year fiscal projections for 2020 call for sales revenue of 660.0 billion yen, up 1.5% over the previous year; business profit of 55.0 billion yen, up 9.7%; operating profit of 54.5 billion yen, down 6.9%; and profit attributable to owners of parent of 38.0 billion yen, down 9.5%. Yokohama’s plans call for paying annual dividend of 64 yen per share for the year—an interim dividend of 32 yen and a year-end dividend of the same amount.

Financial Highlights

Results by Business Segment