News Release

Yokohama Rubber Releases Fiscal Results for First Three Quarters of 2015

2015.November.10

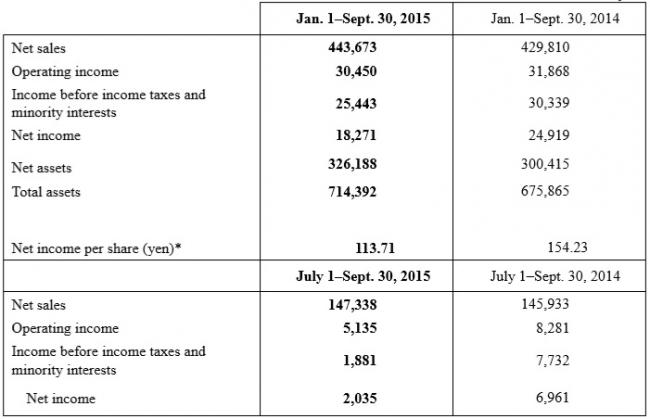

- Management relation

Tokyo - The Yokohama Rubber Co., Ltd., announced today that its sales increased and earnings declined in the first three quarters of 2015 (January to September). Net sales increased 3.2% over the same period of the previous year, to 443.7 billion yen; operating income declined 4.4%, to 30.5 billion yen; and net income declined 26.7%, to 18.3 billion yen. Business expanded in Yokohama’s tire segment as overseas sales gains offset sluggish sales in Japan. In the company’s Multiple Business segment, sales expanded overall, driven by gains in industrial materials; in sealants, adhesives, and electronic equipment coatings; and in aircraft fixtures and components.

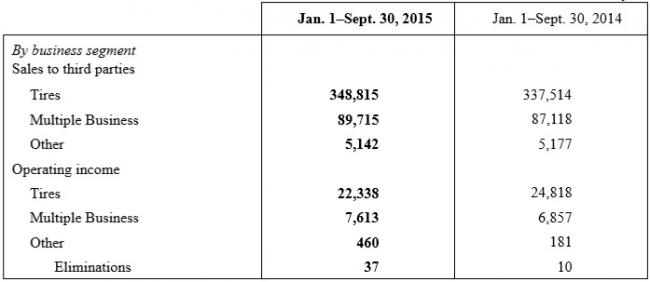

Yokohama’s nine-month sales in the tire segment increased 3.3% over the same period of the previous year, to 348.8 billion yen, and operating income declined 10.0%, to 22.3 billion yen. The downturn in operating profitability, which occurred despite declining prices for raw materials and the weakening of the yen, resulted from escalating price competition. In Japan, Yokohama’s original equipment business declined on account of a continuing downturn in Japanese vehicle production. Yokohama registered declines in yen value and in unit volume, meanwhile, in the Japanese replacement market. Those declines reflected the aftereffects of the April 2014 hike in Japan’s national sales tax; lighter-than-usual snowfall in the Tokyo region, which diminished demand for studless snow tires; and escalating price competition. Leading Yokohama’s overseas sales growth were robust growth in North America and expanding sales volume in China and Russia.

Nine-month sales in Yokohama’s Multiple Business segment increased 3.0% over the same period of the previous year, to 89.7 billion yen, and operating income rose 11.0%, to 7.6 billion yen. That segment consist mainly of high-pressure hoses, sealants and adhesives, electronic equipment coatings, conveyor belts, antiseismic products, marine hoses, pneumatic marine fenders, and aircraft fixtures and components.

In high-pressure hoses, sales declined despite sales gains in automotive hoses in North America. That decline reflected continuing global weakness in the resources development sector and slowing economic growth in China. Business expanded in industrial materials, as Yokohama posted overseas sales gains in marine hoses and Japanese sales gains in the construction and civil engineering sector, led by antiseismic products. Sales increased overall in sealants and adhesives, which Yokohama markets under the Hamatite brand, and in coatings for electronic equipment. That increase occurred as overseas growth in automotive sealants more than offset weakness in construction sealants. Business expanded in aircraft fixtures and components, led by growth in the commercial aircraft sector.

Escalating competition in the tire segment has occasioned a revision of the fiscal projections that Yokohama announced in August. The company now projects net sales of 648 billion yen, up 3.6%; operating income of 55 billion yen, down 6.9%; and net income of 33 billion yen, down 18.5%. Yokohama paid an interim dividend of 13 yen per share, and management proposes to pay a year-end dividend of 26 yen per share. The company carried out a one-for-two share merger effective July 1, 2015. Yokohama’s proposed aggregate dividend would be in accordance with the company’s earlier projection, adjusted for the share merger.

Financial Highlights (Millions of yen)

*Yokohama has calculated and stated the figures for net income per share as if the one-for-two share merger conducted on July1, 2015, had been conducted on January 1, 2014.

Results by Business Segment (Millions of yen)

Notes:

1. Yokohama has prepared this information in accordance with accounting principles generally accepted in Japan.

2. The Multiple Business segment, established in the present fiscal year, comprises the operations formerly categorized as “Industrial Products” and the aircraft fixtures and components business formerly included in “Other Products.” Yokohama has restated its nine-month results by business segment for fiscal 2014 to reflect this change retroactively.