News Release

Yokohama Rubber Posts Highest Ever First-Half Totals for Sales and Earnings

2014.August.08

- Management relation

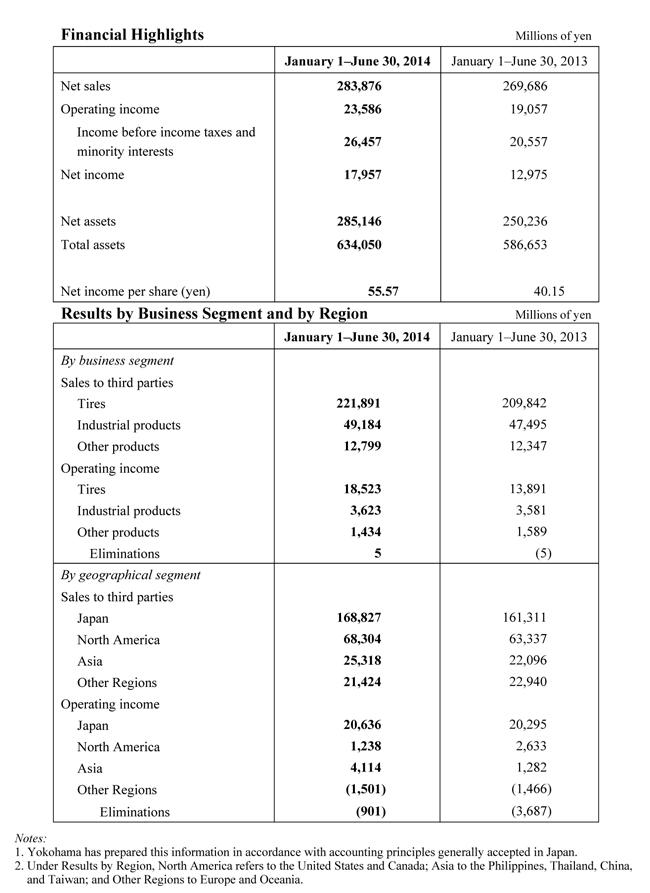

Tokyo - The Yokohama Rubber Co., Ltd., announced today that its net sales, operating income, and net income reached record first-half highs in the first half of 2014. Net income climbed 38.4% over the same period of the previous year, to 18.0 billion yen, on a 23.8% increase in operating income, to 23.6 billion yen, and a 5.3% increase in net sales, to 283.9 billion yen.

Underlying the robust fiscal performance were business gains in tires, in industrial products, and in other products. Yokohama achieved strong sales growth in tires in Japan and in overseas markets. In industrial products, it registered solid sales gains in high-pressure hoses and in sealants and adhesives. Renewed growth in golf equipment, meanwhile, energized the company’s business in other products. Earnings in each segment benefited additionally from a downward trend in raw material prices and from the weakening of the yen.

Operating income in Yokohama’s tire operations increased 33.4% over the same period of the previous year, to 18.5 billion yen, on a 5.7% increase in sales, to 221.9 billion yen. Yokohama posted vigorous growth in original equipment business in Japan. Driving that growth were a surge in demand in advance of the April 1 hike in Japan’s national sales tax, increased shipments of tires for fuel-saving vehicle models, and success in winning fitments on additional vehicle models.

Yokohama’s Japanese business in replacement tires also expanded vigorously, including growth in studless winter tires and in summer tires. As in original equipment, replacement business benefited from surging demand in advance of the hike in the national sales tax. Heavy snowfalls stimulated demand, meanwhile, for Yokohama’s studless winter tires. In overseas business, recovery in North America, in Europe, and in China more than offset continuing weak demand in Russia and in some other markets.

Operating income in Yokohama’s industrial products business edged up 1.2%, to 3.6 billion yen, on a 3.6% increase in sales, to 49.2 billion yen. That business consists primarily of high-pressure hoses, sealants and adhesives, conveyor belts, antiseismic products, marine hoses, and marine fenders. Yokohama posted sales gains in Japan in hoses for construction equipment, in sealants and adhesives for construction and for automobiles, and in conveyor belts. Highlighting business outside Japan were North American sales gains in automotive hoses.

In other products, operating income declined 9.8%, to 1.4 billion yen, on a 3.7% increase in sales, to 12.8 billion yen. Yokohama’s business in golf equipment featured strong growth in Japanese sales of the iD nabla and egg lines of golf clubs and sales gains in the Republic of Korea and in Taiwan. Business in aircraft fixtures and components was weak in the government sector, but sales were strong in lavatory modules for commercial aircraft.

Yokohama has revised downward the 647 billion yen full-year sales projection that it issued in February 2014, to 635 billion yen. That would be an increase of 5.5% over the previous year. The company abides by its February projection of 63 billion yen for operating income, an increase of 11.2%, and it has revised upward its February projection of 37.5 billion yen for net income, to 42 billion yen. The upward projection suggests an increase in net income of 20.0%. Yokohama has announced an interim dividend of 12 yen per share, an increase of 2 yen over the previous interim dividend, and management has proposed a year-end dividend of 14 yen per share, also an increase of 2 yen over the previous year. Those increases would bring the full-year dividend to 26 yen per share, an aggregate increase of 4 yen over the previous year.