Message from the President

Using the principles of “offense and defense” as a guideline for management

Since becoming President of Yokohama Rubber in 2017, I have been asked a lot about my motto. In such cases, I always try to answer“play offense and defense (Sogyo Shusei).”

The term “Sogyo Shusei” is found in the “The Essentials of Governance” by Emperor Taizong of the China’s Tang Dynasty which contains exchanges between the emperor and his ministers. The term questions whether it is more difficult to establish a new country or to protect it, but I think it raises an essential issue that is also common to modern management, even though it was written about 1,400 years ago. In management, if we interpret “Shusei” (defense) as internal improvements for business continuity and “Sogyo” (offense) as a growth strategy, which is more important? I find that both are equally important, and I believe that we cannot survive in the market unless we promote them at the same time.

In order for a company to grow sustainably, it must pursue both increased sales and profits in terms of performance, and investments in growth areas made possible by profits. It is naturally important to carry out existing business activities steadily. On the other hand, it is also important to establish (“Sogyo”) a business and create new value by innovating it in anticipation of drastic changes in the environment. They are not separate, but complementary.

While making a solid profit from existing businesses and securing

cash flow, we will establish (“Sogyo”) new businesses using that cash. The strategy of creating and expanding business domains through M&A and other means is also part of the founding (“Sogyo”) process. I believe that only by continuing to implement these approaches will we be able to achieve revenue growth. This way of thinking is the basis of my management philosophy, and I continue to put it into practice consistently as a principle in management.

Promoting YX2023 strategies based on market changes

In fiscal 2022, as the second year of our three-year medium-term management plan YOKOHAMA Transformation 2023 (YX2023) launched in 2021, we worked to further promote the plan based on the positive results of the first year.

The basic strategies are to pursue the “Exploitation” of strengths in existing businesses, and to promote “Exploration” to seek new possibilities in markets facing a once in a century transformation.

The current global tire market is valued at about ¥20 trillion, of which consumer tires such as passenger car tires and commercial tires such as tires for trucks, buses, and agricultural machinery each account for about half of the total. However, emerging trends such as Connected, Autonomous, Shared, Electric (CASE), Mobility as a Service (MaaS), and Digital Transformation (DX) are projected to reduce the number of privately owned vehicles and increase the demand for infrastructure vehicles. Furthermore, when comparing our current situation with the global market, the composition ratio of consumer tires and commercial tires is 1:1 in the global market, while the same ratio for Yokohama Rubber is 2:1, showing bias towards consumer tires. As customer needs shift from individuals to corporations and consumer tires shift to commercial tires, we are strategically promoting initiatives by emphasizing two approaches: “Exploitation” of consumer tires and “Exploration” of opportunities in commercial tires.

In consumer tires, we are focusing on three categories of ADVAN ultra-high-performance tires, GEOLANDAR tires for SUVs and pickup trucks, and WINTER tires, with the aim of maximizing the high value- added tire sales ratio. Our goal is to boost profits by increasing the ratio of high value-added tires sold from 40% in fiscal 2019 to 50% or more.

In commercial tires, there is an urgent need to grow off-highway tires (OHT) in order to bring our overall composition closer to the market composition ratio and to increase profits. By adding Trelleborg Wheel Systems Holding AB (TWS), which we acquired in May 2023, to our tire business, we will not only optimize the overall revenue composition, but also make it a more profitable product mix compared to the market, and strengthen our commercial tire product lineup, cost, service, and DX. Applying the aforementioned concept of “Sogyo Shusei,” the expansion and strengthening of high-value-added products in consumer tires is regarded as defense (“Shusei”) when it comes to the transformation of the Group's entire business portfolio. Through the acquisition of TWS, we will realize a full lineup within the OHT business at once and achieve non-continuous growth, which can be described as offense (“Sogyo”) in regard to the business domain that will become our new strength.

Record high sales revenue and profits in fiscal 2022

In fiscal 2022, despite a challenging business environment marked by the ongoing situation in Ukraine, soaring raw materials prices and logistics costs, a reduction in automobile production due to the semiconductor shortage, surging energy costs due to inflation, and a sharp deterioration in business sentiment, sales revenue totaled ¥860.5 billion and business profit was ¥70.1 billion, setting new record highs for the second consecutive year following fiscal 2021. This strong performance is attributed to strong sales in North America and other regions as a result of efforts to expand sales of high value-added products and OHTs for agricultural machinery in our mainstay tire business, improve the MIX, and raise prices in Japan and overseas. In addition, the yen's depreciation, which has continued since last year, also contributed to business performance.

Accelerated shift of consumer tires to high value-added products

In consumer tires, we are working to expand original equipment (OE) use of ADVAN and GEOLANDAR on new vehicles, strengthen return sales in the replacement market, expand the product size lineup including winter tires, and strengthen sales measures tailored to each region. In fiscal 2022, a large number of luxury cars and EVs were equipped with ADVAN or GEOLANDAR tires. In addition, in the replacement market, we positioned fiscal 2022 as the “YOKOHAMA Summer Offensive”-themed year and worked to expand sales, focusing on new ADVAN products. As a result of these activities, the ratio of high value-added products reached 42% in fiscal 2022.

In fiscal 2023, we will continue to maximize the ratio of high value-added products. Under the theme of “Mud Match,” we will strengthen sales of GEOLANDAR tires, launch new products, and expand the size lineup. We will also increase the ratio of high value- added products to 47% and seek to achieve the target of 50%.

ADVAN, which will celebrate its 45th anniversary in 2023, has always been used in racing since its inception. We will continue to carry out grassroots activities that literally support the feet of racing fans. The reason I decided to join the company was simple: I like cars and motorcycles. Motorsports is considered a grand testing ground for technological development, and through the supply of high-performance tires, we hope to showcase our “quality” and “fun to drive” attributes and strongly emphasize the presence of Yokohama Tire to fans and the market.

Our achievements in motorsports included the following. We won back the series championship for the first time in two years in the GT300 class of the 2022 SUPER GT. In the United States, a car with ADVAN tires has won the overall championship running at the 100th Pikes Peak International Hill Climb, and a car with GEOLANDAR tires won the overall victory in the Asia Cross Country Rally 2022. These stellar results both inside and outside of Japan show that Yokohama Rubber’s technologies truly lead the field in motorsports and beyond.

Our tires, which have been highly evaluated around the world through these efforts, are now used in such iconic performance cars as Mercedes-Benz in its top-grade AMG and BMW M.

In commercial tires, the growing OHT business posted substantial growth

One of our most significant achievements in fiscal 2022 was the acquisition of Trelleborg Wheel Systems Holding AB (TWS) in the OHT business, which is a growth driver.

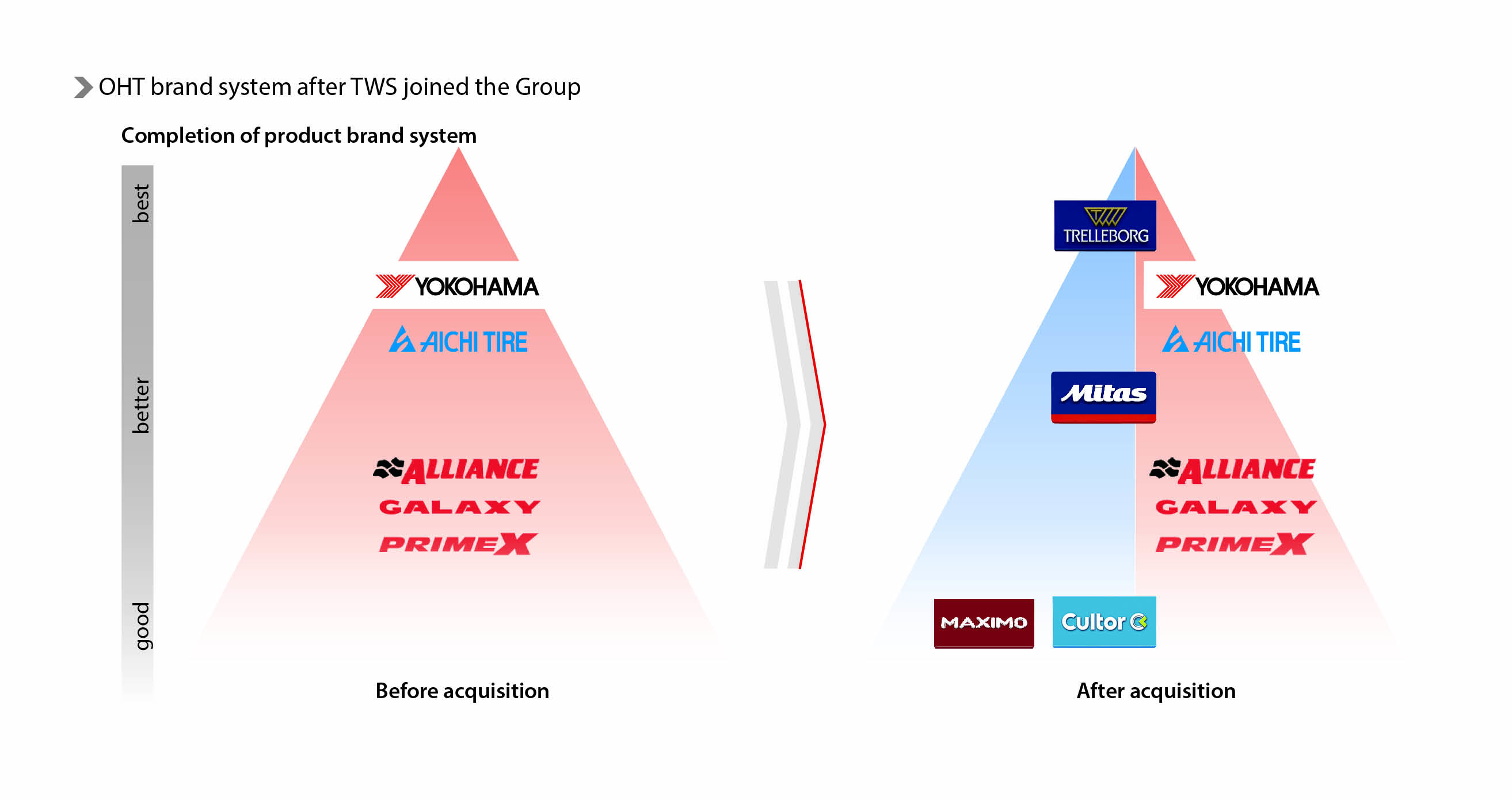

In order to respond to business changes such as the increased demand for commercial tires, we acquired Alliance Tire Group (ATG) in 2016 and Aichi Tire Industry in 2017 to position our business for growth. Subsequently, in 2021, we integrated our OHT business with ATG and Aichi Tire Industry to form Yokohama Off-Highway Tires, and we are now working together to promote our growth strategy.

The TWS acquisition is a major acquisition with a different significance from previous acquisitions and business integrations. TWS is developing its global production and sales business of tires for agricultural machinery and industrial vehicles, mainly in Europe, Asia (including China), North America, and Central and South America. Estimates place its enterprise value at 2,074 million euro (using a performance-linked earn-out method) and EBITDA multiple at approximately 9.5 times. Particularly noteworthy are the company’s premium brands.

To date, Yokohama Rubber OHT has significantly increased sales and profits, mainly for cost-competitive products made in India. In addition, the acquisition will add premium brand Trelleborg and standard brand Mitas to complete the good, better and best product lineup. In addition, as our production sites and sales channels are expanding around the world, our diverse lineup will provide greater stability against economic fluctuations. Moreover, by incorporating the maintenance and inspection services of premium brands and DX know-how into the Group, we can expect to improve the services of the entire Group. Eventually, we would like to unify our R&D system across the Group and incorporate advanced European knowledge in the environmental field.

Creating a large number of business synergies in this way and increasing the ratio of highly profitable OHT businesses will enable us to improve the stability of our business and further grow our sales revenues.

Furthermore, in order to meet the growing demand, the new plant in Visakhapatnam, India began operations ahead of schedule in August 2022. In fiscal 2023, we will proceed with full capacity operation and the second phase of enhancements. In the truck and bus tire business, the Mississippi Plant in the U.S. has improved supply and production has reached a record high, and we are also investing in increasing production at the Mie Plant. Our production of small-diameter

truck tires, for which demand is growing, and tires for regular trucks and buses will increase by more than 100,000 units. In Japan, we are actively supporting the transportation business using a next-generation tire management system (T.M.S) that utilizes IoT, and are promoting DX.

MB business focusing resources on growth businesses

In the MB (Multiple Business) business, we focused resources on our strengths in the Hose & Couplings business and Industrial Products business.

In the Hose & Couplings business, we decided to reorganize our automotive production systems in the United States and Mexico, and to increase production at the Ibaraki Plant, following our investment in increased production capacity at our Chinese plant for hydraulic hoses. Going forward, we will increase our production capacity for large-diameter products to seize demand.

In the Industrial Products business, as a result of efforts to maximize our domestic market share of conveyor belts, strengthen domestic sales, and expand the lineup of standard inventory, we achieved sales 1.5 times larger than the previous fiscal year and acquired a market share of about 50%. In order to further maximize our market share, we will continue to increase the production capacity of the Hiratsuka Factory.

In terms of structural reforms, in November 2021, we transferred the Hamatite business, which produces and sells adhesives and sealants, to Sika AG, headquartered in Switzerland, and in March 2022, we integrated the Aerospace Parts Division into the Industrial Materials Division.

In fiscal 2023, in the Hose & Couplings business, we will increase the production ratio of automotive hoses in Mexico to 31% and strive to maximize the production capacity of hydraulic hoses at our plant in China. In the Industrial Products Business, we will continue to focus on maximizing our share of conveyor belts and plan to launch new products.

Promoting sustainability management

When applying “Sogyo Shusei” to management, the management foundation plays a particularly important role in defense (“Shusei”). We regard sustainability management as one of our practical business strategies to strengthen our business, and these efforts are leading to the sustainable improvement of corporate value through various activities from an environmental, social, and governance perspective.

Our corporate slogan is “Excellence by nature,” and this phrase applies perfectly to environmental initiatives. Since we are a business that deals with natural rubber, we believe that it is our responsibility as a company to contribute to the sustainability of society. We have been working to protect the environment and reduce CO2 emissions from an early stage, and have been disclosing greenhouse gas emissions up to Scope 3 since fiscal 2013. In recognition of these efforts, we have been selected for inclusion in the FTSE4Good Index Series for 18 consecutive years and the FTSE Blossom Japan Index for six consecutive years.

In fiscal 2022, we further accelerated our activities in the environmental field, such as turning the Shinshiro-Minami Plant into a carbon- neutral model plant, researching and developing tires using sustainable materials, and working toward Nature Positive through the planting of the YOKOHAMA Forever Forest activities. Furthermore, in January 2023, we endorsed the philosophy of the Task Force on Nature-related Financial Disclosures (TNFD) and participated in the TNFD Forum, an international stakeholder organization that supports the establishment of a framework to encourage companies to disclose information on risks and opportunities related to the natural environment and biodiversity. Also in January, we joined the 30 by 30 Alliance for Biodiversity, a coalition launched by Japan’s Ministry of the Environment and other organizations with the goal of conserving and protecting more than 30% of the land and sea by 2030.

Human capital is also a priority measure in YX2023, and through the formulation of the Human Rights Policy and personnel system reform in 2022, we are creating an organization that enables diverse human resources to demonstrate their abilities without being limited

in their work styles. As part of these efforts, in March 2023, we integrated the Shimbashi Head Office and the Hiratsuka Factory. The aim of this integration is to break away from vertically divided operations by eliminating the physical distance between departments and to speed up decision-making from the perspective of total optimization. By creating an environment where business can be executed regardless of location or time, we will improve business efficiency and make decisions more quickly. In order to quantitatively grasp employee engagement for these initiatives, we plan to conduct an engagement survey this year.

We will strengthen governance and sell a portion of our cross-shareholdings, which have been considered to be high in the industry, and will continue to actively reduce them. Diversity is one of our issues, but in fiscal 2022, we appointed a woman as an outside director and are working to increase this number one step at a time.

With the aim of strengthening the supervisory function of the Board of Directors, we transitioned our governance structure from a Company with an Audit & Supervisory Board to a Company with an Audit and Supervisory Committee on March 30, 2023. With the progress of business globalization, the proportion of foreign shareholders

is also increasing, but we are still about 10% below the market average. In fiscal 2023, we will enhance effectiveness by strengthening our governance system, further improving these activities, and actively disclosing information in a fair and transparent manner.

Taking the next step after reaching ¥1 trillion in sales revenue for the first time

The current economic situation in Japan is recovering against the backdrop of increased production in the automobile industry and production machinery industry, mainly due to the improvement in the supply situation of semiconductors, and increased personal consumption and inbound tourism consumption, while raw material prices continue to climb. Overseas, capital investment has been slowing due to monetary tightening and the bankruptcy of some banks in the United States that surfaced in January. In Europe, while the situation in Ukraine shows no signs of improvement, financial system anxiety has erupted due to the bankruptcy of financial institutions in the United States, and high inflation continues to weigh on the economy.

Overall, the business environment remains challenging, but as I have explained so far, the Group has promoted a portfolio shift without exception in each business, and has decisively sold assets or allocated them to growth investments with an eye toward future business development.

Our investment policy is based on the cost of capital (WACC). When investing, we carefully select portfolio companies using the discounted payback period method, which determines whether theinvestment can be recovered within 10 years, and proactively raise funds through the sale of cross-shareholdings so that we can use our own funds as much as possible.

During YX2023, we sold our fixed assets at the Head Office and the Hamatite business in 2021, and sold cross-shareholdings in 2022. In 2023, we sold a tire wholesale subsidiary in the United States and have already sold cross-shareholdings on two occasions, resulting in a gain of ¥11.4 billion. Going forward, we plan to continue selling non-business assets such as cross shareholdings, and use the cash obtained to repay loans and make new investments.

As a result of these initiatives, the further depreciation of the yen,

the downward trend in ocean freight rates, and the completion of the acquisition of TWS, we expect both sales and profit to exceed fiscal 2022 and reach record highs in fiscal 2023. We expect to see sales revenue of ¥1 trillion and business profit of ¥84.5 billion, operating profit of ¥87.0 billion, and profit attributable to owners of the parent of ¥57.0 billion. Under the motto of stable dividends and consecutive dividends, we plan to increase dividends for the third consecutive year to ¥68 per share, paying out an interim dividend of ¥34 per share and a year-end dividend of ¥34.

In 2017, the 100th anniversary of Yokohama Rubber, we had set targets of net sales of ¥1 trillion and operating profit of ¥100 billion, but unfortunately we fell short. This year, the final year of YX2023, we will achieve ¥1 trillion in sales revenue, which is the culmination of the past 100 years and could not be achieved in the Medium-Term Management Plan GD100 (Grand Design 100) from fiscal 2006 to fiscal 2017, and we will take the next step toward new growth.

As a company, various factors are necessary to ensure that we achieve increased sales and profits and continue to achieve profitable growth in a sustainable manner. To that end, it is necessary to appropriately utilize people, goods, and money. We will continue to take on the challenge of enhancing our corporate value over the next 100 years through appropriate investment and the creation of new value for our stakeholders. We will contribute to the creation of a sustainable society together with our stakeholders and grow as a company trusted by customers around the world.

I ask for your continued support and understanding as we move forward.