News Release

Yokohama Rubber Rewrites Records for Net Sales, Operating Income, and Net income in First Three Quarters of 2014

2014.November.10

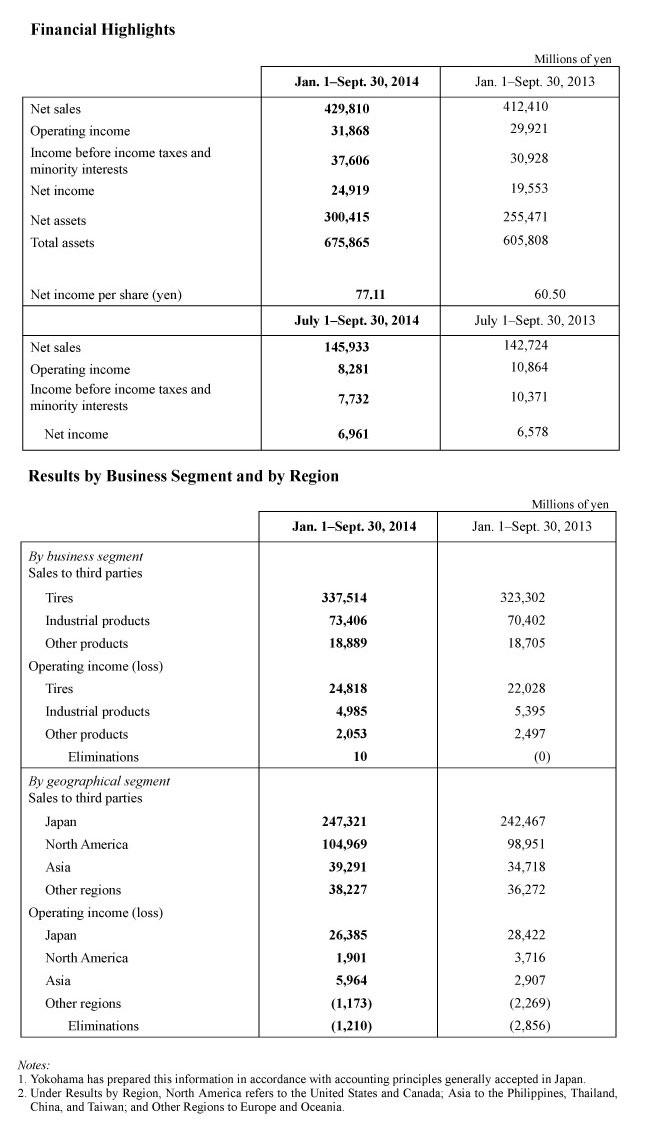

- Management relation

Tokyo - The Yokohama Rubber Co., Ltd., announced today that its sales and earnings rose to record levels in the first three quarters of 2014 (January to September). Net sales increased 4.2% over the same period of the previous year, to 429.8 billion yen; operating income increased 6.5%, to 31.9 billion yen; and net income increased 27.4%, to 24.9 billion yen. All three of those totals were Yokohama’s highest ever in the nine-month period from January to September.

Driving the record nine-month sales performance were gains in Yokohama’s core tire operations, led by growth in original equipment business in Japan and by growth in overseas markets. Yokohama also posted growth in industrial products and in other products, led by strong growth in sealants and adhesives and in golf equipment. The nine-month gains in sales and profitability benefited greatly from declining prices for raw materials and the weakening of the yen.

Yokohama’s nine-month sales in tire operations increased 4.4% over the same period of the previous year, to 337.5 billion yen, and operating income increased 12.7%, to 24.8 billion yen. The company’s Japanese sales of original equipment tires increased, boosted by domestic growth in unit vehicle production. Yokohama also posted gains in Japanese sales of replacement tires, both in unit volume and in value. Those gains reflected a surge in demand in advance of the April hike in Japan’s national sales tax; growth in sales of snow tires, stimulated by heavy snowfall; and stepped-up promotion of Yokohama’s BluEarth line of fuel-saving tires. The sales growth overseas included gains in China and in Europe.

In Yokohama’s industrial products operations, nine-month sales increased 4.3% over the same period of the previous year, to 73.4 billion yen, and operating income declined 7.6%, to 5.0 billion yen. Those operations consist mainly of high-pressure hoses, sealants and adhesives, conveyor belts, anti-seismic products, marine hoses, and marine fenders. In high-pressure hoses, Yokohama posted sales gains in hoses for construction equipment in Japan, in locally produced automotive hoses in North America, and in Japanese exports of automotive hoses. The company’s sales of industrial materials declined despite a recovery in overseas business in marine hoses, as overseas demand for conveyor belts slumped. Business expanded in sealants and adhesives and in electronic materials, led by gains in the construction sector.

Yokohama’s nine-month sales in other products increased 1.0% over the same period of the previous year, to 18.9 billion yen, and operating income declined 17.8%, to 2.1 billion yen. That business consists mainly of aircraft fixtures and components and golf equipment. Leading the sales growth in golf equipment were Yokohama’s egg golf clubs. In aircraft fixtures and components, sales were basically unchanged from the same period of the previous year as sales gains in the private sector offset a decline in the government sector.

For the full year, Yokohama abides by the projections that it announced in August: net sales of 635 billion yen, up 5.5%; operating income of 63 billion yen, up 11.2%; and net income of 42 billion yen, up 20.0%. The company has announced that the annual dividend will total 26 yen per share, up 4 yen over the previous year: an interim dividend of 12 yen and a year-end dividend of 14 yen, each up 2 yen.