News Release

Yokohama Announces First-Quarter Fiscal Results

2016.May.13

- Management relation

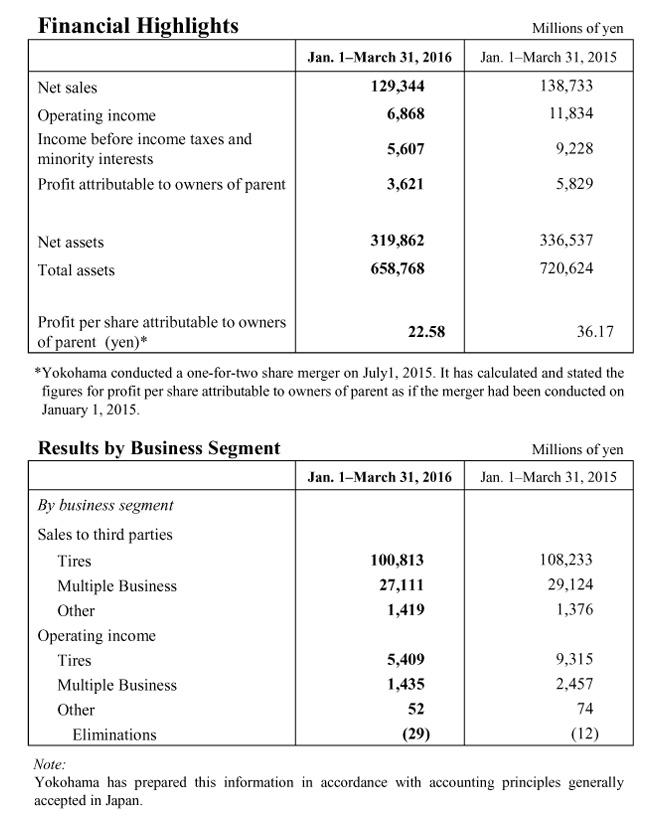

Tokyo—The Yokohama Rubber Co., Ltd., announced today that its sales and earnings declined in the fiscal first quarter (January to March) of 2016, compared with the same period of the previous year. Profit attributable to owners of parent declined 37.9%, to 3.6 billion yen, on a 42.0% decline in operating income, to 6.9 billion yen, and a 6.8% decline in net sales, to 129.3 billion yen. Affecting sales adversely were a unit decline in vehicle production in Japan and a downward trend in tire prices worldwide. Those and other adverse factors more than offset the earnings contribution of declining prices for raw materials. Also affecting earnings adversely was the appreciation of the yen.

In Yokohama’s tire segment, operating income declined 41.9%, to 5.4 billion yen, on a 6.9% decline in sales, to 100.8 billion yen. Business in the original equipment sector in Japan slumped on account of the unit decline in vehicle production and a downward trend in tire prices. Yokohama posted gains in unit volume and in yen value in the Japanese market for replacement tires. Leading those gains were robust sales of high-value-added tires under Yokohama’s global flagship brand, ADVAN, and fuel-saving tires under the BluEarth brand.

Yokohama posted unit sales growth outside Japan, though overseas sales declined in yen value on account of the appreciation of the yen and escalating price competition. The company posted unit sales growth in North America, led by gains in tires for sport-utility vehicles, and its sales mix improved in the North American market. In Europe, strong sales of winter tires in 2015 carried over into sales momentum in summer tires in early 2016. Also contributing to the unit sales growth outside Japan were gains in the original equipment market in China.

Operating income declined 41.6% in Yokohama’s Multiple Business segment, to 1.4 billion yen, on a 6.9% decline in sales, to 27.1 billion yen. Business in that segment consists principally of high-pressure hoses; sealants, adhesives, and electronic equipment coatings; conveyor belts; antiseismic products; marine hoses and pneumatic marine fenders; and aircraft fixtures and components. Business was weak in high-pressure hoses on account of declining demand for automotive hoses and for hoses for construction and mining equipment. The decline in the construction and mining sector reflected the global downturn in natural resources development and slowing infrastructure investment in China.

In industrial materials, sales decreased as a decline in Japanese steel production and as slumping prices for crude oil. Sales were basically unchanged in Yokohama’s business segment that handles Hamatite-brand sealants and adhesives and coatings for electronic equipment. That resulted as growth in overseas business in automotive sealants offset a decline in construction sealants amid weakening demand. Sales increased in aircraft fixtures and components, led by gains in the government sector.

Yokohama abides by the first-half and full-year fiscal projections for 2016 that it announced in February 2016. Those projections call for profit attributable to owners of parent to decline 16.8% in the first half, to 13.5 billion yen, on a 13.1% decline in operating income, to 22.0 billion yen, and a 1.2% increase in net sales, to 300.0 billion yen. For the full year, they call for profit attributable to owners of parent to decline 6.4%, to 34.0 billion yen, on 0.9% increase in operating income, to 55.0 billion yen, and a 3.5% increase in net sales, to 652.0 billion yen. Yokohama announced in March 2016 that it would purchase all of the shares of the Netherlands-based tire manufacturer Alliance Tire Group B.V. It will release updated fiscal projections when it has calculated the probable effect of that acquisition on its fiscal performance.